Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

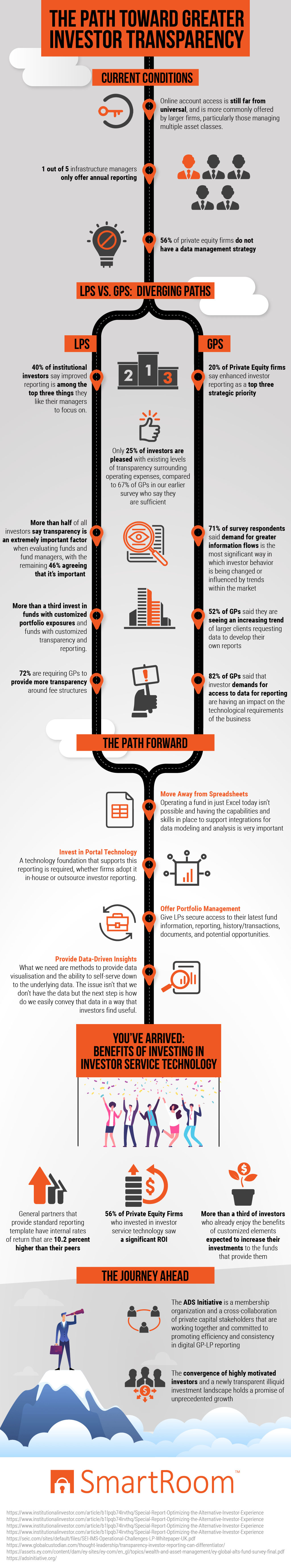

CURRENT CONDITIONS

In spite of the incremental steps that have been taken in recent years to improve conditions, there continues to remain a large disparity between standard types of investing and private equity. Investors who place their dollars in a mutual fund, for example, are readily able to access information on every charge that they incur. There is no mystery when it comes to management and performance fees, which is in marked contrast to what private equity investors still experience.

This lack of transparency is evident in several ways. For one thing, access to information from online sources remains unavailable to a wide swath of investors. For many, data is only distributed once per year in the form of the annual report. This situation is made worse by the fact that over half of the country’s private equity companies have not yet come up with a strategy to effectively manage their data.

LPS VS. GPS: DIVERGING PATHS

Limited partners (LPs) are the external investors who contribute their capital into one or more of the funds that the firm handles. This type of structure is not designed for everyone; in fact, investors usually need to shell out at least $250,000 to participate. For that reason, many LPs are not individuals but instead may be foundations, university endowments, pension funds and the like. LPs are only liable for the amount they contribute to the fund, which is managed by the general partner.

Since LPs do not have a direct relationship with their invested monies, it stands to reason that these individuals and companies desire as much transparency in reporting as possible from the general partner who is responsible for managing them. When investors can get their hands on these valuable details on an on-demand basis, they are in a much better position to evaluate the general partner’s performance.

More than a third of LPs choose to have additional control over their funds with customized portfolio exposures. There are several types:

- Security constraints concern conditions that dictate which specific funds cannot be bought or sold and which are held or replaced. These conditions help to match client personal preferences, facilitate balanced portfolios and counterbalance various types of risk;

- Sector constraints help to determine whether funds should always or never be put into certain industries or types of companies;

- Social criteria or restrictions prevent investment in companies of which the client does not approve for religious, ethical or other reasons;

- Minimum or maximum amounts of cash to be invested.

In addition to these customizable features, almost three-quarters of all LPs want the GP with whom they work to be much more open about the types of fees they charge as well as the reasons for each.

General partners want to please the LPs they already have on board and attract more. They also understand that investors are not only demanding more information but are using it to shape the decisions they make. Therefore, it comes as no surprise that 20 percent of the survey respondents list enhanced investor reporting as an important emerging priority.

When today’s savvy LPs do not get the portfolio-related information they want in their desired amount or frequency, they tend to take matters into their own hands. In fact, more than half of the surveyed GPs report that their clients are starting to ask for the data necessary to create their own reports. As a result, general partners are being stretched in new ways, forced by the demands of LPs to find new technological vehicles to provide the information that is being requested.

This trend for requesting added transparency from GPs appears to be increasing in strength and urgency. Only a quarter of the LPs surveyed are happy with the status quo in this arena, a marked drop from the 67 percent of satisfied investors recorded in the past questionnaire.

THE PATH FORWARD

While Excel addresses basic data analysis and management needs, it falls short of the mark for the complex environment of private equity. Limitations include the following:

- Collaboration is difficult;

- Security is minimal;

- Multiple versions of documents can exist;

- Files can be easily corrupted, and it can be difficult to track who made the mistake;

- Instability;

- Difficulty in integrating data;

- Access constraints;

- Issues in creating comprehensive reports;

- Program is dated and clumsy.

It is far better for firms to integrate all of their information through the use of private equity or venture capital software that is suited to the particular needs and constraints of this specialized industry.

For either in-house or out-sourced reporting, portal technology aids in facilitating maximum transparency, security, reliability and visibility for LPs who want real-time access to their data. It provides information about fund performance, residuals, contributions and distributions directly from their funds’ official records. Thanks to this technology and office portfolio management software, they can expect flawless data visualization, access to underlying data in real time, performance reporting and secure delivery of documents.

Private equity firms are repositories for a vast store of data for their investors. Now that LPs are asking for enhanced access to this information, the challenge for firms lies in coming up with technological and communication strategies that will facilitate easy, real-time sharing of specifics about their granular underlying data.

When general partners take actions to meet investors’ requests for enhanced information about their data, positive results ensue. Internal rates of return are more than 10 percent higher, and return on investment (ROI) is increased for the majority of private equity firms who took the leap to use advanced investor service technology. Clients who are already benefiting from customized portfolios anticipate that they will invest additional funds with the private equity firm that has gone the extra mile to give them the specific reports and funding strategies that they request.

THE JOURNEY AHEAD

The Adopting Data Standards (ADS) Initiative consists of a network of private capital stakeholders. Their goals include the following:

- Coming up with a live, GP-LP proof-of-concept for reporting;

- Building consensus and promoting reporting efficiency and consistency;

- Arriving at a set of standards that are accepted worldwide;

- Fostering industry-wide engagement and participation in a “commercially neutral” initiative.

Thanks to this collaboration, a foundation of efficiency and transparency can be fostered among all of the stakeholders in the process.