Last Updated on October 22, 2025

Tax due diligence in M&A is a critical step that can make or break a deal. Whether you’re on the buy side or the sell side, understanding the tax due diligence process helps uncover potential tax risks that could affect the purchase price, deal structure, and even whether the transaction closes at all.

In mergers and acquisitions, tax reviews go far beyond checking past tax returns. They involve examining financial statements, contracts, and supporting documentation to assess potential tax exposure for the target company. This means identifying tax issues like unreported income, improper tax credits, missed filings, or payroll errors involving employees and independent contractors.

A well-planned diligence process not only reduces risk exposure but also puts buyers and sellers in a stronger position during negotiations. It ensures tax implications are clear, surprises are avoided, and both sides understand the true value of the business before moving forward.

Understanding Tax Due Diligence in M&A

Tax due diligence is a targeted review of a company’s tax position during mergers and acquisitions. It helps both buyers and sellers identify tax risks, confirm compliance, and understand the tax implications of the deal before signing agreements. The main goal is to uncover any potential tax exposure that could affect the purchase price or lead to penalties after closing.

The tax due diligence process goes deeper than just reviewing tax returns for the past three years. It examines financial statements, past tax credits, payroll records, sales tax filings, and documentation for deductions and expenses. This allows parties to spot tax issues early and take a proactive approach to address them.

A thorough review can reveal problems like unfiled returns, underpaid income tax, improper use of independent contractors, or missing documentation for tax positions. These diligence findings help shape the deal’s structure, influence whether escrow holdbacks are needed, and determine how liabilities will be handled.

| Purpose of Tax Due Diligence | Key Benefit in M&A |

| Identify tax risks | Prevent unexpected costs after closing |

| Confirm compliance | Avoid IRS audits and penalties |

| Understand tax implications | Adjust purchase price or deal terms |

| Support negotiations | Strengthen position for buyers and sellers |

Without a proper diligence process, both sides risk costly surprises, increased risk exposure, and delays that could push the deal beyond the planned timeline, sometimes up to six months or more.

Key Objectives of Tax Due Diligence

The main purpose of tax due diligence in M&A is to give both parties a clear picture of the target company’s tax position before finalizing a deal. For buyers, it’s about identifying potential tax risks that could lead to unexpected liabilities, while sellers aim to address issues early to protect their position during negotiations. This involves reviewing tax returns, verifying tax credits, checking expense deductions, and confirming compliance with all tax obligations to reduce the risk of penalties or disputes with the IRS or state authorities.

Another key objective is to understand the tax implications of the transaction and how diligence findings might influence the purchase price, escrow holdbacks, or deal terms. Discovering unpaid income tax, sales tax, or other tax issues can result in changes to agreements and indemnification clauses. By resolving problems before closing, both sides can protect deal value and move forward with confidence, reducing the risk of costly surprises after the merger or acquisition.

Impact of Tax Due Diligence on Deal Structure

The tax due diligence process often has a direct effect on how a mergers and acquisitions deal is structured. When diligence findings reveal potential tax exposure, the buyer may adjust the transaction terms to protect against future liabilities. This can include:

- Lowering the purchase price to offset expected tax risks

- Requesting escrow holdbacks to cover potential tax due after closing

- Adding stronger indemnification clauses to protect against tax issues

- Changing payment terms or requiring additional warranties from the seller

In some cases, the structure of the deal itself changes due to tax implications. An asset purchase may be favored over a stock purchase, or vice versa, depending on which structure minimizes tax liabilities and maximizes value for both parties. By conducting thorough tax due diligence, both buyers and sellers can negotiate a deal structure that addresses potential tax risks while safeguarding their financial and legal interests.

Sell-Side Tax Due Diligence

Sell-side tax diligence gives a seller the chance to review their own tax position before a buyer starts their review. This proactive approach can help uncover and resolve tax issues that might otherwise reduce the purchase price or slow down the due diligence process. Starting several months before going to market gives sellers time to fix problems and gather all necessary documentation.

Benefits of conducting sell-side tax due diligence include:

- Identifying potential tax risks before the buyer’s review

- Correcting errors in tax returns, deductions, or tax credits

- Ensuring documentation is complete for expenses and deductions

- Reducing risk exposure and avoiding last-minute surprises

- Strengthening the seller’s position in negotiations

- Potentially securing a higher sale price by proving compliance

Common diligence findings on the sell side include incorrectly deducted expenses, missing support for tax credits, and gaps in payroll or sales tax reporting. By resolving these issues early, sellers can simplify the diligence process, keep the deal on schedule, and maintain focus on running the business during mergers and acquisitions.

Buy-Side Tax Due Diligence

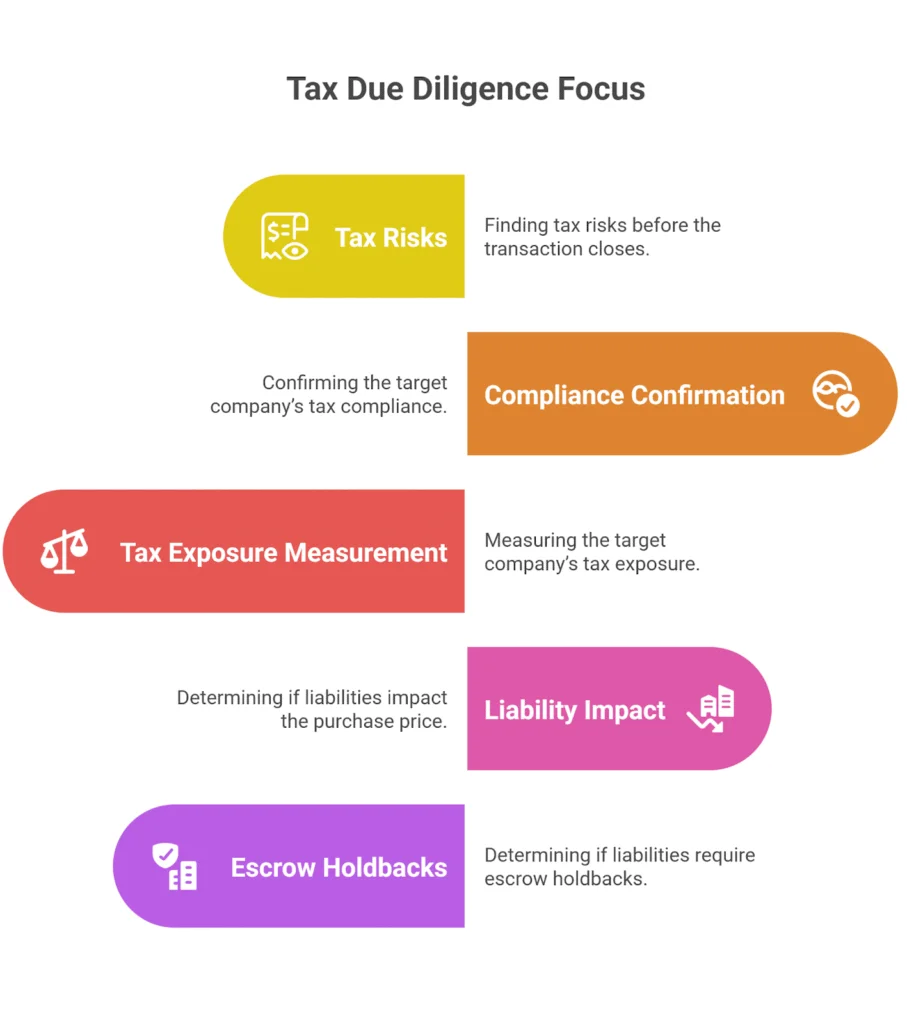

For buyers, tax due diligence in M&A focuses on finding tax risks before the transaction closes. It confirms the target company’s compliance, measures tax exposure, and determines if liabilities could impact the purchase price or require escrow holdbacks. The review covers tax returns from the past three years, payroll records, sales and use tax filings, financial statements, documentation for tax credits and deductions, and classification of employees and independent contractors. Interviews with management help clarify findings.

If the process uncovers unpaid income tax, underreported sales tax, or other tax issues, buyers may seek price adjustments, add indemnification clauses, or require extended warranties. Serious unresolved problems can delay or even cancel the deal, making thorough buy-side tax due diligence critical to protecting the buyer’s interests.

The Tax Due Diligence Process Step-by-Step

A thorough tax due diligence process in mergers and acquisitions starts with an information request list tailored to the target company. This typically includes tax returns for the past three years, financial statements, payroll reports, sales and use tax filings, and documentation for tax credits and deductions. The goal is to effectively review compliance, identify potential tax exposure, and confirm the accuracy of reported expenses and income. Interviews with management help clarify any discrepancies or unusual items found during the review.

Once all data is analyzed, the findings are compiled into a report that outlines tax risks, recommended actions, and possible impacts on the purchase price or deal terms. These diligence findings can lead to requests for escrow holdbacks, indemnifications, or adjustments in payment structure. Depending on the complexity of the transaction, the process can take from one to three months, or up to six months for more complicated deals.

Common Findings in Tax Due Diligence

A focused tax due diligence process often reveals issues that affect deal value and terms in mergers and acquisitions. These diligence findings can lead to changes in the purchase price, escrow holdbacks, or indemnification requirements.

- Incorrectly deducted expenses

- Missing documentation for tax credits or deductions

- Underreported sales or income tax

- Misclassification of employees and independent contractors

- Gaps in payroll or sales tax reporting

Risks of Skipping or Rushing Tax Due Diligence

Skipping or rushing the tax due diligence process in mergers and acquisitions can lead to serious financial and legal consequences. Without a proper review, buyers risk inheriting unpaid income tax, sales tax liabilities, or compliance issues that could have been identified beforehand. For sellers, overlooked tax issues can resurface after closing, resulting in penalties, disputes, or damage to reputation.

Incomplete or hasty diligence also weakens negotiating power. Without clear insight into tax risks and potential tax exposure, parties may agree to unfavorable purchase price terms or fail to secure protections such as escrow holdbacks and indemnifications. In some cases, unresolved tax liabilities can delay or derail the entire transaction.

Best Practices for Effective Tax Due Diligence

Successful tax due diligence in M&A starts with preparation. Both buyers and sellers should engage experienced tax professionals who understand the complexities of mergers and acquisitions. Using a tailored tax due diligence checklist ensures the review covers all necessary areas, including tax returns, financial statements, payroll records, sales and use tax filings, and documentation for tax credits. Starting early, often months before the deal reaches advanced stages, gives more time to address findings without delaying the transaction.

Clear communication between both sides can speed up the diligence process and reduce misunderstandings. All diligence findings should be documented, reviewed, and resolved before finalizing the deal to avoid potential tax exposure later. Addressing tax implications upfront not only mitigates tax risks but also helps preserve the value of the purchase price and improves the chances of a smooth closing.

Frequently Asked Questions

What is M&A tax due diligence?

M&A tax due diligence is the review of a target company’s tax history and compliance during mergers and acquisitions to identify risks, liabilities, and opportunities.

What is the tax due diligence process?

The tax due diligence process involves reviewing tax returns, financial statements, payroll records, and other documents to assess tax risks and compliance.

What is the M&A due diligence checklist?

An M&A tax due diligence checklist is a list of required documents and areas to review, such as income tax filings, sales tax records, and payroll compliance.

Conclusion

Tax due diligence in M&A is essential for protecting deal value and avoiding costly surprises. A thorough review of tax returns, financial statements, and supporting documentation helps identify tax risks, clarify tax implications, and guide better negotiations. Whether on the buy side or sell side, addressing issues early reduces risk exposure, strengthens positions, and supports a smoother closing. In mergers and acquisitions, the right tax due diligence process can be the difference between a deal that builds value and one that creates problems after signing.

Patrick Schnepf is the Senior Vice President of Global Sales at SmartRoom, where he leads strategic initiatives to enhance secure file-sharing and collaboration solutions for M&A transactions. With a career spanning over two decades in sales and business development within the technology sector, Patrick has been instrumental in driving SmartRoom’s global revenue growth and expanding its market presence. He is a growth-oriented leader who excels at building go-to-market strategies that accelerate adoption, deepen customer relationships, and business impact.