Last Updated on July 2, 2025

Table of Contents

Legal risk is one of the biggest dealbreakers in M&A and corporate transactions. Hidden clauses, outdated terms, and non-compliant language buried in contracts can lead to costly delays, or worse, failed deals.

Today, AI-powered tools are helping risk managers and legal professionals review contracts faster, flag suspicious patterns, and detect risks across unstructured data. Using machine learning, natural language processing, and advanced algorithms, these systems analyze large volumes of documents with greater speed and accuracy than ever before.

For financial institutions, law firms, and dealmakers, implementing AI means less time spent on time-consuming tasks, and more time focused on strategic work, regulatory compliance, and reducing false positives. With tools like SmartRoom, identifying red flags and managing your risk posture is no longer reactive, it’s smarter, faster, and built for scale.

What Is AI Risk Detection in Legal Documents?

AI risk detection is the use of artificial intelligence, including machine learning, natural language processing, and advanced analytics, to identify legal and compliance risks in contracts, agreements, and other business-critical documents.

Instead of reading line-by-line, AI-powered tools can now analyze large volumes of unstructured data to detect:

- Non-compliant clauses

- Outdated or missing terms

- Red-flag language tied to regulatory compliance, money laundering, or fraudulent transactions

These tools use AI models trained on real-world legal documents to flag issues with speed and accuracy. For example, a system might identify a risky indemnity clause, track suspicious activities across deal versions, or highlight terms that conflict with company policies or ethical standards.

Legal teams and risk professionals use these tools to reduce time-consuming tasks, limit false positives, and focus human effort where it matters most. The result? Faster reviews, improved risk posture, and fewer surprises during due diligence.

Bottom line: AI risk detection helps dealmakers and legal teams go beyond basic document review, by using technology to find hidden risks and stay compliant.

Top Legal Risks AI Can Flag During a Deal

When reviewing contracts, even a single missed clause can expose a company to lawsuits, regulatory violations, or financial loss. That’s why dealmakers are now using AI-powered tools to catch high-risk issues early, before they derail a transaction.

Here are the most common legal risks AI can detect during contract review:

1. Non-Compliance with Regulatory Standards: AI can flag language that violates regulatory compliance laws, such as GDPR, FCPA, or anti-money laundering rules, especially in cross-border or highly regulated sectors.

2. Hidden or Risky Clauses: Risk managers rely on AI to detect problematic terms like:

- Broad indemnification language

- Uncapped liabilities

- Hidden renewal or termination traps

- Change-of-control triggers

3. Expired, Missing, or Incomplete Terms: AI systems detect incomplete documentation, expired agreements, and key sections (like signatures or exhibit references) that may be missing or inconsistent.

4. Inconsistent Language Across Versions: Using natural language processing, AI can compare document versions to identify contract drift or conflicting obligations, especially important in fast-moving M&A deals.

5. Suspicious Patterns or Past Risk Indicators: Some platforms use data analytics and deep learning to flag red flags based on past incidents or suspicious activities found in similar agreements.

By automatically surfacing these issues, AI helps legal professionals and risk management teams avoid costly surprises and streamline risk assessment across large volumes of documents.

Benefits of AI Risk Detection for Dealmakers

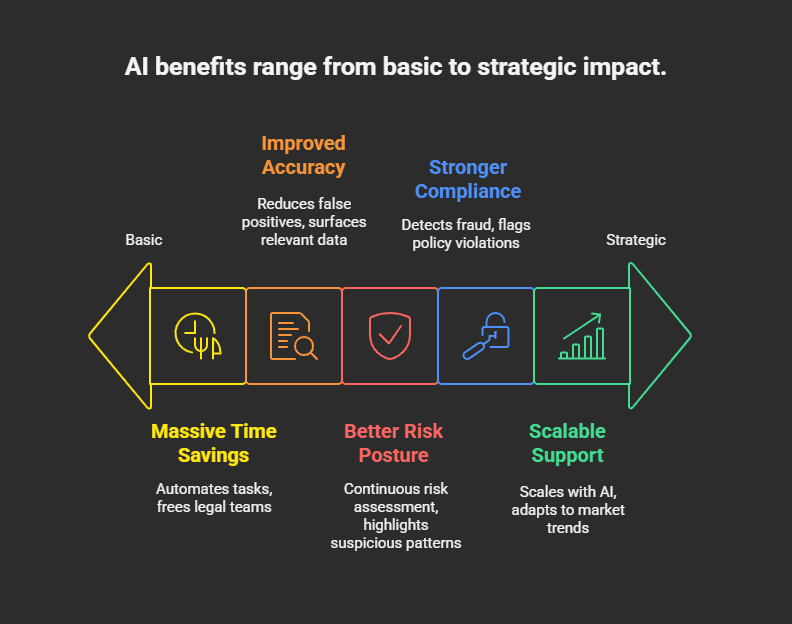

For dealmakers under pressure to move fast without missing red flags, AI-powered tools offer more than speed, they offer smarter, safer, and more strategic execution.

Here’s how:

1. Massive Time Savings

AI can analyze large volumes of contracts in minutes, automating time-consuming tasks like clause tagging, version comparison, and language analysis. This frees legal teams to focus on strategic work instead of manual review.

2. Improved Accuracy and Fewer False Positives

By using machine learning algorithms trained on thousands of legal documents, AI improves model performance over time, reducing false positives and surfacing only the most relevant data.

3. Better Risk Posture

AI tools support risk professionals and risk managers by making risk assessment continuous and proactive. They highlight suspicious patterns, identify missing terms, and help maintain regulatory alignment across all documents.

4. Stronger Compliance and Security

Modern platforms include security measures to handle sensitive data, detect fraudulent transactions, and flag content that violates company policies or ethical considerations, all crucial for financial institutions and regulated industries.

5. Scalable Legal Support Without the Law Firm Overhead

Instead of hiring more associates for every deal, firms and enterprises can scale with AI capabilities that continuously learn and adapt to new market trends, industry language, and evolving regulatory purposes.

In short, using AI in legal review isn’t just efficient, it gives dealmakers a competitive edge in closing faster, safer, and more informed deals.

How SmartRoom Enables Smarter Compliance

When it comes to high-stakes deals, AI risk detection isn’t just about speed, it’s about confidence. SmartRoom’s AI-powered tools give dealmakers, legal professionals, and risk managers an efficient, secure way to flag issues, streamline workflows, and ensure regulatory compliance at every stage.

Here’s how SmartRoom helps teams stay ahead:

Deep Integration with VDR Workflows

Because SmartRoom operates within a secure virtual data room, users can review contracts, assess risk posture, and collaborate without exporting files or exposing sensitive data. Everything stays inside a controlled, encrypted environment, with full security measures in place.

Designed for Legal and Risk Teams

Unlike generic AI solutions, SmartRoom is tailored for legal analysis, risk management, and compliance professionals. It’s built to align with industry standards, support ethical considerations, and enhance human oversight, not replace it.

Limitations and Human Oversight

While AI-powered tools can dramatically improve the speed and precision of contract review and risk assessment, they’re not a silver bullet. Human expertise remains essential, especially in high-stakes transactions where nuance, context, and legal interpretation matter.

Here’s what dealmakers and legal professionals need to keep in mind:

- AI Doesn’t Replace Legal Judgment

Even the best AI models can misread intent or miss subtle issues. Legal analysis, negotiation strategy, and risk prioritization still require a human lens, especially when stakes are high or documents are highly specialized.

- Risk of False Positives or Over-Flagging

While AI can dramatically reduce noise, early-stage systems may still generate false positives, flagging language that appears risky but is actually standard in a particular group of contracts or industries. Model performance improves over time, but it must be monitored.

- Ethical and Regulatory Boundaries

Using AI for risk management must align with internal company policies, industry regulations, and ethical considerations. For example, AI shouldn’t be the final authority on whether to pursue a deal involving potential fraudulent transactions or sensitive data.

- AI Needs Accurate, Up-to-Date Data

Implementing AI effectively depends on access to accurate data, clean inputs, and systems trained on large amounts of relevant legal precedent. Without that, even advanced algorithms can struggle with unstructured data or outdated templates.

- Human Oversight Ensures Strategic Impact

Ultimately, the value of AI isn’t just in catching small risks, it’s in freeing humans to focus on the big ones. With the right guardrails, teams can pair AI capabilities with human expertise to deliver accurate results, maintain compliance, and focus on strategic work.

Conclusion: Smarter Deals Start With Smarter Risk Detection

In a world where deals move fast and legal risks can be buried deep, artificial intelligence (AI) is no longer optional, it’s essential. For dealmakers, risk professionals, and legal teams, the ability to surface hidden issues, scan large volumes of documents, and maintain regulatory compliance is now a critical part of doing business.

AI-powered tools like SmartRoom offer a powerful way to reduce time-consuming tasks, limit false positives, and help teams make faster, better-informed decisions. Whether you’re identifying suspicious patterns, catching fraudulent transactions, or aligning with global security measures, leveraging AI gives you the competitive edge to close deals with confidence.

But smart tech alone isn’t enough. The best outcomes come when human expertise and AI capabilities work together, balancing automation with judgment, speed with scrutiny, and risk detection with strategic insight.

If you’re handling sensitive data, reviewing complex contracts, or managing compliance under pressure, now is the time to explore what smarter, AI-powered legal risk detection can do for you.

Frequently Asked Questions About AI Risk Detection in Legal Documents

1. What is AI risk detection in legal contracts?

AI risk detection refers to the use of artificial intelligence, such as machine learning and natural language processing, to analyze legal documents and flag risks. These include non-compliant clauses, outdated terms, and suspicious patterns that may violate regulatory or company policies.

2. Can AI replace lawyers in contract review?

No. AI supports legal professionals by automating time-consuming tasks, but it does not replace legal judgment. Human oversight is essential for interpreting nuanced clauses, negotiation strategy, and making final risk decisions.

3. How accurate is AI in identifying legal risks?

Modern AI systems trained on thousands of legal documents offer high accuracy and reduce false positives over time. However, accuracy depends on model performance, data quality, and continuous oversight from legal teams.

4. What types of risks can AI detect in contracts?

AI tools can detect:

Regulatory violations (e.g., GDPR, FCPA)

Risky clauses like uncapped liabilities or indemnification

Missing or expired terms

Conflicting language across versions

Indicators of fraud, money laundering, or phishing attempts

5. Is AI safe for handling sensitive data in legal workflows?

Yes, if implemented with proper security measures. Trusted platforms like SmartRoom offer encrypted environments and strict access controls to handle sensitive data in compliance with industry standards.

6. What are the limitations of using AI in legal risk detection?

AI may:

Misinterpret complex or unusual contract language

Flag false positives in certain industries

Require accurate, up-to-date data to perform reliably

This is why combining AI capabilities with human expertise is essential for effective risk management.

Matthew Small is the Vice President of Strategic Sales and Alliances at SmartRoom, where he builds partnerships and leads strategic efforts to deliver cutting-edge virtual data room solutions for dealmakers. With a strong background in enterprise sales and channel development, Matthew is passionate about unlocking new growth opportunities and helping clients navigate complex transactions with greater speed, security, and confidence.