Last Updated on October 20, 2025

When a large company seeks to sharpen its focus and unlock value in its portfolio, it might turn to a carve-out M&A as a strategic alternative. Rather than fully divesting a division, the parent company sells a portion of a business unit, often via an equity carve-out and initial public offering, while retaining control and continued ownership. The result is a new entity that operates as a standalone company but still maintains a connection to the original parent.

This model has gained renewed traction. In Q1 2024, carve-out deals accounted for 15.5% of U.S. middle-market private equity buyouts, up from 7.6% in 2022. Meanwhile, a global survey of dealmakers found that 48% are considering divestitures or carve-outs as part of their strategic playbook. These figures signal that carve-outs are evolving from niche maneuvers into central instruments in corporate reorganization.

However, the path isn’t without its pitfalls: executing a carve-out requires careful planning, robust transition services agreements, precise financial statements, and rigorous due diligence to succeed.

What Is a Carve-Out in M&A?

A carve-out M&A happens when a parent company sells part of a business unit but keeps some level of ownership and control. Unlike a full divestiture, which severs ties completely, a carve-out creates a new entity that runs as a standalone company yet stays connected to the parent.

In practice, this means a large company separates a division into a new subsidiary or new company. The carved-out operation gains its own financial statements, leadership team, and often a dedicated board. Meanwhile, the parent company raises cash while still shaping the strategic goals of the carved-out business.

One common approach is the equity carve-out. Here, the parent sells a minority stake in the subsidiary through an Initial Public Offering (IPO). This lets existing shareholders and new investors buy into the standalone entity, while the parent keeps a majority stake. It’s a way to test the market value of the divested business without giving up full control.

How Carve-Out M&A Transactions Work

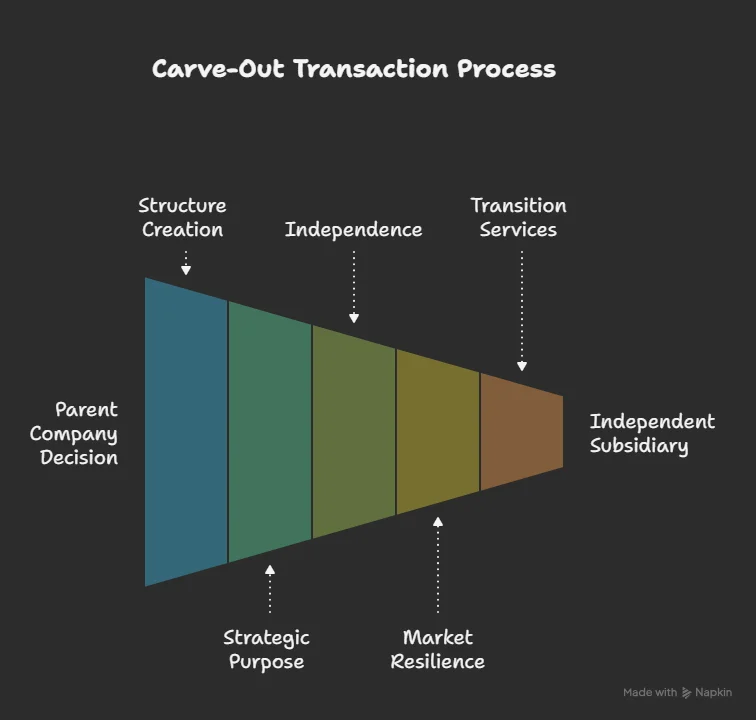

A carve-out transaction is more than just a sale; it is a carefully structured deal that balances the needs of the parent company, the carved-out company, and potential buyers. At its core, a carve out involves creating a new entity that can operate on its own while still giving the parent financial and strategic benefits.

1. The Structure

In an equity carve-out, the parent company sells a minority stake of the subsidiary through an initial public offering. This approach provides immediate liquidity but allows the parent to maintain control with a majority stake. The carved-out business unit is presented to the market as a standalone company, with its own financial statements and board.

2. Strategic Purpose

Companies pursue carve-outs to generate significant value without abandoning future upside. For the parent company, the move can improve cash flow, sharpen focus on core operations, or even test how much the market values a new subsidiary. For smaller companies spun out of larger groups, it can be a way to create strategic alliances, build strategic partnerships, and pursue growth that wasn’t possible inside the parent’s structure.

3. Independence of the Subsidiary

The carved-out company becomes an independent entity with its own management team, giving it more freedom to align with its strategic goals. With a debt free balance sheet, the new organization often finds it easier to arrange separate funding from investors or lenders. This autonomy lets it lead its own strategy while still benefiting from ties to the parent.

4. Market Resilience

Carve-outs have remained strong in the market even during volatile times. Because a corporate carve out doesn’t fully detach, it offers investors a lower-risk way to participate in a business that is partially supported by the parent company. This hybrid model often appeals to both financial buyers and strategic investors looking to capture most value from underutilized assets.

5. Transition Services Agreements

One key feature of the carve out process is the Transition Services Agreement (TSA). Since many support functions, contracts, and systems remain tied to the parent, a TSA ensures continuity. It allows the parent company to keep providing services like IT, HR, or finance until the new company is fully capable of operating on its own. Without this step, even a successful carve out could stumble during the early months of independence.

Carve-Outs vs. Spin-Offs vs. Divestitures

Carve-outs are often confused with spin-offs and divestitures, but each has a different role in corporate strategy. Knowing the differences is a key step for companies, investors, and buyers who want a clear understanding of how these deals impact ownership, control, and value creation.

Carve-Outs

A carve-out transaction separates a business unit from its parent by creating a new entity that functions as a standalone company. In most cases, the parent company sells a minority stake through an equity carve-out and an initial public offering. The parent maintains a majority stake, which means it can still influence the strategic goals of the carved out company. For the parent, the main benefit is immediate cash while keeping upside potential.

Spin-Offs

A spin-off also results in a new subsidiary, but here the parent company distributes shares of the new company directly to its existing shareholders. No money changes hands at the time of the separation. The result is two completely separate entities with distinct operations. For investors, a spin-off increases exposure without requiring new investment. For the parent, however, there’s no direct cash inflow, only a cleaner organization.

Divestitures

A divestiture goes further than either of the above. Here, the company sells a business unit or assets entirely to another buyer. The sale severs all ties, leaving no shared ownership or control between the two companies. A divestiture can generate immediate liquidity and simplify the organization, but it also means giving up any future benefit if the divested business grows.

| Feature | Carve-Out | Spin-Off | Divestiture |

| Cash Flow | Yes, via IPO (equity carve) | No | Yes, via outright sale |

| Ownership | Parent retains majority stake | Shareholders receive new shares | Parent exits fully |

| Control | Parent maintains partial control | None | None |

| Entity Created | New standalone company | New independent entity | Business sold to another buyer |

| Strategic Use | Test market value, raise cash, keep ties | Sharpen focus, shareholder value | Exit non-core business, raise capital quickly |

Quick Comparison Table

Benefits of Carve-Outs for Parent and Subsidiary Companies

A well-planned carve-out transaction creates value for both sides. The parent company gains financial flexibility, while the carved out company steps into independence with room to grow.

For the Parent Company

The main benefit is liquidity. When the parent company sells a minority stake through an equity carve-out, it raises funds without losing control. That cash can reduce debt, support the existing business, or fuel new strategic goals. At the same time, retaining a majority stake preserves upside if the new subsidiary performs well. Carve-outs also streamline operations by shedding non-core assets and sharpening long-term strategy.

For the Subsidiary

The carved-out company becomes a standalone company with access to separate funding, often starting with a debt free balance sheet. This independence makes it more attractive to investors and gives leaders freedom to create their own culture, build strategic alliances, and pursue new customers. In many cases, a successful carve out unlocks growth that wasn’t possible under the parent.

Challenges in Carve-Out Transactions

While carve outs can deliver significant value, they are also among the most complex deals in the M&A space. A carve-out transaction forces companies to untangle years of shared assets, people, and processes, which can stretch the deal timeline and raise risks for both buyer and seller.

1. Tax and Deal Structure Complications

The way a carve out involves separating a business unit can trigger major tax implications. Whether the parent chooses an equity carve-out, asset sale, or hybrid approach, the structure directly affects overall deal value. A poorly planned structure can leave both the parent company and the buyer exposed to unexpected liabilities.

2. Operational Entanglements

Many divested businesses rely on the parent’s support functions , from IT and payroll to shared contracts and facilities. Separating these into two companies takes time and precision. Without careful planning, employees, suppliers, and customers may face disruption, threatening the success of the transaction.

3. Due Diligence Requirements

Because the carved-out business may never have operated independently, due diligence becomes especially challenging. The parent company must prepare reliable financial statements for the divested business to present to potential buyers. This step often requires building carve-out financials from scratch, which is costly and time-consuming.

4. Market Risk Perceptions

Some investors view carve outs as riskier than acquiring a standalone company. The reliance on transition services agreements to bridge the separation can make buyers nervous, especially if there’s uncertainty around when the new entity will truly be self-sufficient. This perception can impact valuation and slow negotiations.

Carve-Out Process and Best Practices

A carve out process is complex, requiring careful planning, financial preparation, and smooth execution. Each stage determines whether the carve-out transaction becomes a successful carve out or faces setbacks.

1. Planning the Carve-Out

The parent company must define why it’s separating the business unit , to raise capital, sharpen corporate strategy, or streamline operations. Leaders then identify shared assets, contracts, and support functions that must be divided. A project management team, backed by a clear timeline, ensures the process stays on track. Communication with employees, stakeholders, and customers is critical for maintaining trust.

2. Execution Phase

Next, the company prepares carve-out financial statements so buyers can complete due diligence. If the business unit was never a standalone entity, this step can be difficult but is essential. A transition services agreement often bridges the gap, allowing the new company to use the parent’s IT, HR, or finance systems until it’s self-sufficient. Tax and legal planning are also crucial since the way the company sells the stake, through an equity carve-out or asset transfer, shapes the deal value.

3. Post-Carve-Out Phase

Once the separation is complete, the new subsidiary must operate as an independent entity, building its own systems and governance. A debt free balance sheet gives it better access to funding and room to create growth. Meanwhile, the parent company can monitor performance to decide if a future sale or spin off is the right move.

Related Deal Structures

Not all corporate separations take the form of a carve-out transaction. Companies can choose other paths depending on their needs, resources, and strategic goals. Three common alternatives include asset sales, management buyouts, and variations of carve-out strategies.

Asset Sales Overview

In an asset sale, the company sells specific assets, contracts, or liabilities directly to a buyer. This move generates quick cash without creating a new entity or standalone company. Unlike a corporate carve out, where both the parent company and the carved out company remain connected, an asset sale usually results in a clean break.

Management Buyouts (MBOs)

A management buyout takes place when the business unit’s existing leadership team acquires the carved-out operations. This structure can benefit employees and managers who already understand the organization and its customers. It often leads to smoother continuity and stronger strategic partnerships, since the new owners already know how to run the business day-to-day.

Carve-Out Strategies

Different carve out strategies exist beyond the classic equity carve-out. Companies may pursue a pure asset sale, an IPO-based equity carve, or even a hybrid approach combining both. Choosing the right strategy depends on whether the parent company prioritizes cash generation, retaining control, or preparing the subsidiary for eventual full separation.

Key Insights & Opportunities in Carve-Outs

Carve-outs are no longer rare events; they’ve become a regular part of the global M&A playbook. Companies use them to create liquidity, focus on core assets, and test the market value of divisions that might become successful carve outs in their own right.

1. Corporate Realignment

For many corporations, a carve-out transaction is about more than cash. It’s a chance to streamline the organization, reduce complexity, and sharpen strategic goals. By separating a non-core business unit, the parent company can free up resources to strengthen areas with the most value, while the carved out company pursues its own growth path as an independent entity.

2. Opportunities for Investors

A favorable funding environment has made carve-outs attractive for financial buyers and private equity firms. Because the parent company often retains a majority stake, the new company enters the market with stability, making it less risky than a pure start-up. At the same time, the subsidiary’s debt free balance sheet creates room to secure separate funding and scale quickly.

3. Unlocking Strategic Value

For the parent company, a carve-out can serve as a trial run , testing whether the new subsidiary is strong enough to stand alone or whether a future sale makes sense. For the subsidiary, independence opens doors to strategic partnerships, new customers, and untapped markets. This dual opportunity means both the parent company and the carved-out entity can benefit if the transaction is executed well.

4. Growing Role in Corporate Strategy

Recent surveys show nearly half of global executives are actively considering carve outs or divestitures as part of their forward-looking corporate strategy. This rise highlights a shift: carve-outs are not just short-term cash grabs but a strategic tool for long-term repositioning, value creation, and success in competitive industries.

FAQs About Carve-Out M&A

What is an example of a carve-out?

A good example is FIS’s carve-out of Worldpay. The parent company sold a minority stake in its payments business unit through an equity carve-out, creating a standalone company while keeping a majority stake. This gave FIS liquidity to focus on banking technology while the carved-out company pursued growth in payments.

What is meant by a carve-out?

A carve-out M&A is when a parent company separates part of its business into a new entity. The carve out involves selling shares of a subsidiary to outside investors, often via an Initial Public Offering (IPO). The result is a new company with its own financial statements, board, and operations, while the parent keeps ownership and control.

What is the difference between a spin-off and a carve-out?

In a spin off, the parent company gives shares of the new subsidiary directly to existing shareholders. No cash changes hands, and the two separate entities operate independently.

In a carve-out transaction, the parent company sells a minority stake, often through an equity carve-out IPO, and receives immediate cash. Unlike a spin-off, the parent keeps a majority stake and ongoing influence.

What is the difference between a carve-out and a divestiture?

A divestiture means the company sells a business unit or assets completely, cutting all ties. The buyer gains full ownership, and the parent has no future involvement.

A carve out is different: the parent company retains a majority stake in the new entity, so both the parent and the subsidiary continue to benefit from the arrangement.

Conclusion

Carve-outs have moved from being niche maneuvers to becoming central tools in modern M&A transactions. They give the parent company a way to unlock liquidity, streamline strategy, and still retain a financial interest, while the carved out company gains independence, flexibility, and often a debt free balance sheet to pursue growth.

Still, the carve out process is demanding. From preparing accurate financial statements and managing transition services agreements to handling tax liabilities and long timelines, these transactions test even experienced dealmakers. Success depends on careful planning, rigorous due diligence, and clear communication with buyers, employees, and customers.

Looking ahead, more corporations are expected to use carve outs as a way to refocus portfolios, generate capital, and explore new markets. For investors and financial buyers, they represent opportunities to capture significant value in businesses that may flourish as independent entities. For executives, the lesson is clear: a corporate carve out is not just a financial tactic, it’s a strategic choice that, when executed well, can shape the future of both the parent company and its new subsidiary.

Patrick Schnepf is the Senior Vice President of Global Sales at SmartRoom, where he leads strategic initiatives to enhance secure file-sharing and collaboration solutions for M&A transactions. With a career spanning over two decades in sales and business development within the technology sector, Patrick has been instrumental in driving SmartRoom’s global revenue growth and expanding its market presence. He is a growth-oriented leader who excels at building go-to-market strategies that accelerate adoption, deepen customer relationships, and business impact.