The mergers and acquisitions market is poised to reach near-record levels in 2018. As discussed previously, Washington’s pro-business stance and tax reform have been driving forces in this growth. Now with mega-mergers, where the value is $5 billion or more, it’s almost a foregone conclusion those businesses involved will use big name Wall Street investment banks to advise them on the transaction. But for smaller deals, especially those in the $500,000 to $500 million range, it’s still important to get sound financial advice. For those companies, the choice often comes down to M&A brokers versus M&A advisors. So what’s the difference between the two, and how will you know what’s right when it comes to your transaction?

What is an M&A Broker

In 2014, the U.S. Securities and Exchange Commission defined an M&A broker as someone who facilitates the “transfer of ownership and control of a privately-held company through the purchase, sale, exchange, issuance, repurchase, or redemption of, or a business combination involving, securities or assets of the company.” To put this in layman’s terms, M&A brokers help with soliciting, negotiating and executing deals.

What Does an M&A Broker Do?

When it comes to execution, brokers will help their clients (almost always the seller) determine their objectives for the transaction, price the business, market it to potential customers and facilitate the closing. In some ways, they are similar to realtors, but the product is a business rather than a home. According to Hunter Business Law, a Tampa-based firm that focuses on entrepreneurs, brokers are a particularly good fit for transactions involving smaller businesses. For the seller, it’s important to note that these business brokers usually work on a commission basis fee– typically about 10 percent of the sale price. So there’s no capital outlay unless the deal goes through.

But Hunter Business Law believes the services that M&A brokers can provide are “very limited.” They note particularly that brokers have some limitations when it comes to determining valuations and they encourage sellers to seek out advisors who understand the local business and sector landscape. Additionally, according to industry expert Richard Parker, brokers involvement in negotiations and investigating the business is fairly limited, leaving the bulk of that responsibility in the hands of the buyers and sellers.

What is an M&A Advisor

M&A advisors typically handle more complicated and larger transactions than their broker counterparts. According to the Alliance of Mergers & Acquisitions Advisors, a trade association for these professionals, they represent both buyers and sellers of deals ranging from $5 million – $500 million. So in that, there’s an immediate distinction. But it’s not just the size of the deals that differ, it’s the scope of the services as well.

What does an M&A Advisor Do?

M&A advisors offer a much more robust range of services that can even include accounting, finance and legal in addition to the expected valuation and due diligence. Because they provide greater services including sales strategy and financial analysis, they work off a different fee structure. Advisors will typically work on a retainer fee, so this means that regardless of whether they’re able to find a buyer, the seller will end up paying at least some amount of money.

What are the Differences Between an M&A Broker and an M&A Advisor?

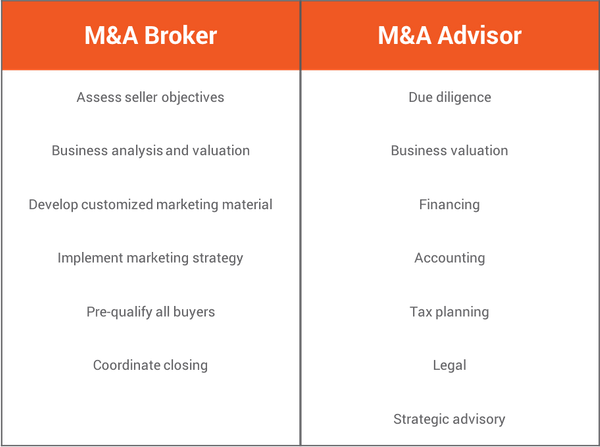

This chart highlights the different job responsibilities and scope of work between these two types of financial advisors.

One of the major issues with M&A advisors is their compensation structure can impact where they lend meaningful support and investment advice. According to a report from the Eisbach Group, a potential M&A target might present significant integration issues. However advisors might not bring these issues to the fore because they don’t have the expertise in recognizing them, nor are they compensated for doing so. Their fee is based only when the deal gets done.

After years of slow movement because of the Great Recession, the M&A market for small- to mid-sized businesses is certainly on the rise. With that, business owners and potential business owners have a lot to consider before embarking on a multi-million dollar transaction. One of those considerations is whether to have someone help you with a transaction and what kind of role you want them to play. Whether you choose an M&A broker, an M&A advisor or someone else, due diligence will play a major role. Using a secure virtual data room to share information between different parties is also crucial to the success of the deal There are many decisions to make before embarking on a business transaction so do you research. Doing so can help make all the difference when it comes to making the right business decision for you and the future of your company.