Last Updated on July 14, 2025

Table of Contents

Understanding your business’s value is essential, whether you’re planning a sale, raising capital, or making strategic decisions. A strong business valuation can help business owners, private equity firms, and investment bankers make informed, confident moves.

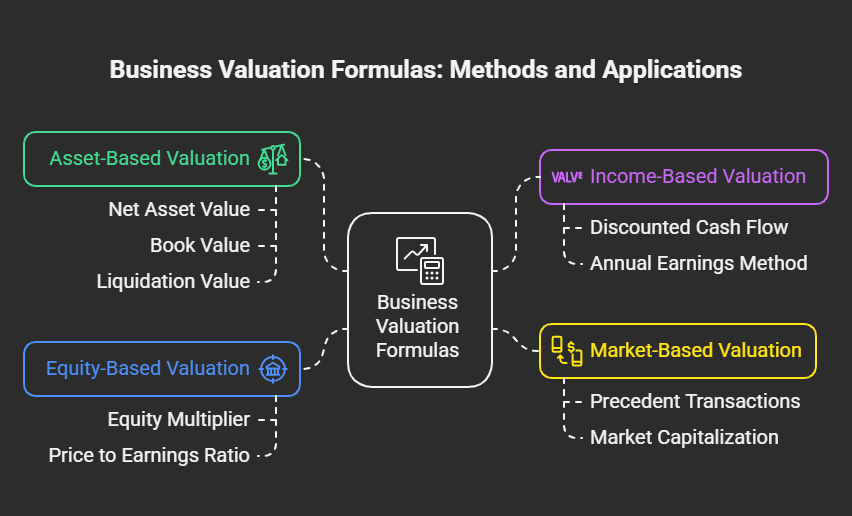

There’s no single way to determine the value of a business. Instead, professionals rely on several common business valuation methods, including:

- Asset based valuation (looking at total assets minus liabilities)

- Market based valuation (comparing to similar businesses)

- Income based valuation (analyzing future cash flows and discounted cash flow projections)

In this guide, we’ll cover key business valuation formulas, how to use a business valuation calculator, and which approach works best based on your company’s size, financial performance, and market position.

Let’s walk through how to calculate your business’s worth using proven methods and tools.

What Are the Three Main Business Valuation Methods?

To determine the value of a business, experts rely on three widely accepted business valuation methods: asset based, income based, and market based approaches. Each method offers a different lens to assess a company’s worth, depending on its assets, earnings, and available market data.

1. Asset-Based Valuation Method

The asset based valuation method calculates a business’s value by subtracting its total liabilities from its total assets valued. This includes both tangible assets (like equipment and inventory) and intangible assets (such as intellectual property, brand reputation, or patents).

It’s particularly effective for companies with substantial net assets, such as a manufacturing company, or businesses preparing for liquidation.

Formula:

Net Asset Value (NAV) = Total Assets – Outstanding Liabilities

This method reflects the book value of the business and is often used by business brokers when evaluating asset-heavy operations.

2. Market-Based Valuation Method

The market based valuation approach estimates a business’s worth by comparing it to similar businesses that have recently sold. This method is commonly used by investment bankers and venture capitalists when there’s enough market data available.

Valuations may use metrics like market capitalization, price to earnings (P/E) ratios, or precedent transaction value calculations, benchmarking a company against deals in the same industry and of similar size.

Best for: Businesses in competitive markets with clear sale value benchmarks.

3. Income-Based Valuation Method

This method values a business based on its ability to generate future cash flows, often using discounted cash flow (DCF) analysis to convert future earnings into present value.

A discounted cash flow calculation factors in the estimated future cash flows, risk (discount rate), and time, offering a forward-looking picture of enterprise value. This approach is ideal for businesses with strong financial performance and predictable annual cash flows.

Formula (basic DCF):

Present Value = Estimated Cash Flow / (1 + Discount Rate) ^ n

It’s a go-to for valuing service-based companies or startups focused on growth.

Each valuation method serves a specific purpose. The right one depends on your industry, business model, and whether you’re optimizing for assets, earnings, or comparable sales.

What Are the Most Common Business Valuation Formulas?

There’s no single formula to calculate a business’s worth. Instead, finance professionals, business brokers, and private equity firms use a range of formulas, each suited to a different valuation method, business model, or financial scenario.

Let’s break down the most commonly used business valuation formulas:

1. Net Asset Value Formula

This asset based valuation formula calculates the company’s current value by subtracting its outstanding liabilities from the value of its total assets, including both tangible assets (equipment, inventory) and intangible assets (trademarks, goodwill).

Formula:

Net Asset Value = Total Assets – Total Liabilities

This formula is ideal for businesses with substantial hard assets and is often used in liquidation value analysis or asset valuation scenarios.

2. Discounted Cash Flow (DCF) Formula

The discounted cash flow value formula is a cornerstone of income based valuation. It estimates the present value of a business by projecting its future cash flows and adjusting for time and risk using a discount rate.

Formula:

Value = (Future Cash Flow × Discount Rate) / (1 + Discount Rate)ⁿ

This discounted cash flow calculation is best for companies with stable cash flows, and it’s a go-to method for venture capitalists, acquiring companies, and firms valuing intellectual property or long-term income potential.

3. Market-Based Value Using Precedent Transactions

This market based valuation formula estimates enterprise value by referencing recent sales of similar businesses within the same industry, also known as precedent transaction value calculation.

Formula (simplified):

Estimated Value = Comparable Company’s Sale Price × (Your Company’s Metric ÷ Comparable Metric)

Common comparison metrics include revenue, EBITDA (earnings before interest taxes depreciation and amortization), or annual earnings.

4. Income-Based Valuation Formula (Annual Earnings Method)

This simplified version of an income based valuation formula uses annual income and a discount rate to estimate the present value of a business’s future earnings. It’s useful for businesses with consistent net income and low volatility.

Formula:

Present Value = Annual Income / (1 + Discount Rate)^(1 / Years)

This helps determine the business’s value based on steady annual cash flows and is commonly applied in small business valuations.

5. Equity Multiplier Formula

This formula connects the current value of a business to its EBITDA and is especially useful when analyzing enterprise value from an investor’s perspective. It helps private equity firms and business owners assess how much value is generated per unit of earnings.

Formula:

Equity Multiplier = Current Value / EBITDA

(EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization)

This is frequently used in price to earnings and market value discussions, especially in deal structuring.

6. Book Value Formula

The book value approach is closely tied to asset based valuation and provides a balance-sheet-based snapshot of the company valuation by comparing asset and liability changes over time.

Formula:

Book Value = (Beginning-Year Assets – End-Year Assets) / (End-Year Liabilities – Beginning-Year Liabilities)

This method reflects the net tangible value of the business and is particularly relevant when evaluating asset-rich entities like a manufacturing company.

7. Market Capitalization Formula

This is one of the simplest and most commonly used ways to measure a public company valuation, especially by investors and venture capitalists. It reflects the market value of a business based on share price and shares outstanding.

Formula:

Market Capitalization = Share Price × Number of Outstanding Shares

While it’s not typically used for small businesses, it sets a benchmark for understanding a business’s market value at a glance, particularly when comparing to similar businesses in the same industry.

8. Liquidation Value Formula

The liquidation value estimates how much a business would be worth if it sold all its assets immediately and paid off its total liabilities. It’s a conservative valuation approach often used by business brokers in distressed scenarios.

Formula:

Liquidation Value = Total Asset Sale Value – Total Liabilities

This formula is especially relevant for companies at risk of insolvency or when calculating a worst-case scenario sale value.

9. Break-Up Value Formula

Used primarily in complex comprehensive valuation analyses, the break-up value estimates the worth of a business if each division or asset were sold separately. It’s often used when evaluating conglomerates or companies with multiple lines of business.

Formula:

Break-Up Value = (Asset Value + Liability Value) – Total Debt

This helps determine the true market value of a company that might be worth more in pieces than as a whole.

10. Price to Earnings (P/E) Ratio Valuation Formula

The price to earnings ratio is a widely used valuation metric, particularly for companies with publicly traded shares or consistent net income. It helps assess how much investors are willing to pay for each dollar of the company’s earnings.

Formula:

Valuation = Net Income × Industry P/E Ratio

Alternatively:

P/E Ratio = Market Value per Share / Earnings per Share

This formula is especially helpful for private equity firms and investment bankers when comparing a business against industry trends and determining whether it’s undervalued or overvalued relative to its peers.

Now that you’ve seen the most common valuation formulas, the next section will show you how tools like a business valuation calculator can turn those formulas into fast, actionable insights.

Business Valuation Calculators: How They Work and What to Input

While formulas offer precision, many business owners prefer the convenience of a business valuation calculator to quickly estimate their company valuation. These calculators combine core valuation formulas with financial inputs to generate a fast, flexible assessment of your business worth.

How Business Valuation Calculators Work

At their core, these tools use formulas based on income based valuation, market based valuation, or asset based valuation models. They analyze inputs like annual earnings, growth rates, risk levels, and asset values to estimate a current market value or enterprise value.

Some calculators use discounted cash flow (DCF) principles, estimating future cash flows and applying a discount rate to calculate present value.

Key Inputs You’ll Need

To use a business valuation calculator effectively, you typically need:

- Annual earnings or net income

- Estimated future cash flows

- Anticipated growth rate over time

- Number of years those cash flows are expected to continue

- A discount rate or risk adjustment factor (like weighted average cost of capital)

- Total assets and total liabilities for asset-based estimations

These inputs work together to produce a discounted cash flow value, net asset value, or comparative market value based on your industry and company size.

Why Business Valuation Calculators Are Useful

A valuation calculator isn’t a replacement for expert guidance, but it’s an excellent tool for:

- Estimating business worth before listing it for sale

- Supporting informed business decisions (mergers, growth planning)

- Starting discussions with business brokers or investment bankers

- Gauging sale value for succession or retirement

- Testing different scenarios using projections and adjustments

The best calculators blend objective financials with future projections, offering fast, data-backed insights you can trust.

Importance of Business Valuation

Knowing the value of a business isn’t just useful, it’s essential. Whether you’re negotiating a sale, seeking funding, planning for retirement, or resolving internal disputes, an accurate business valuation gives you the clarity needed to make informed business decisions.

Strategic Planning & Financial Clarity

A well-supported company valuation helps business owners understand where their business stands financially. It reveals both strengths and weaknesses in the business’s assets, net income, and cash flows, helping guide long-term strategy.

Understanding your current value also supports tax planning, growth strategies, and partnership opportunities.

Securing Capital or Financing

Lenders and private equity firms rely on reliable valuation methods to assess lending risk and investment potential. Whether through discounted cash flow analysis or net asset value, a detailed valuation can help unlock capital for expansion, R&D, or acquisition.

Having strong financial performance backed by a transparent valuation formula can significantly increase your chances of attracting investors or lenders.

Preparing for Sale or Succession

Whether you’re selling your business outright or passing it to the next generation, knowing your business worth is the first step in pricing it correctly. Buyers, including acquiring companies, often use market based valuation or precedent transaction value calculation to evaluate their offers, so you need to come prepared.

Resolving Legal and Ownership Disputes

Disagreements among shareholders or during divorce proceedings often require an unbiased asset based valuation or book value report to determine the fair sale value of a business. Without this, disputes may escalate or end in undervalued settlements.

Supporting Employee Ownership or Equity Plans

If you’re offering shares to employees via ESOPs or profit-sharing plans, a documented business valuation ensures the shares reflect the true market value of the company and comply with financial regulations.

No matter the context, growth, succession, or dispute, business valuation is the financial compass guiding your most important decisions.

Factors That Influence Business Valuation

Every business valuation is shaped by a mix of internal metrics and external market forces. Whether you’re using an income based valuation, asset based valuation, or market based valuation, the accuracy of your business worth hinges on understanding these key influencers.

1. Financial Performance

Your company’s net income, annual earnings, and cash flows form the backbone of most valuation formulas. Strong, consistent financial performance increases your business’s attractiveness and raises its market value.

Metrics like EBITDA (earnings before interest, taxes, depreciation, and amortization) and operating margins are essential in discounted cash flow calculations and other models used by private equity firms and investment bankers.

2. Market Conditions and Industry Trends

External market trends, demand shifts, and the performance of similar businesses all affect your valuation formula outputs. A company operating in a fast-growing industry (like SaaS or clean energy) may see higher market based valuation multiples than a stagnant manufacturing company.

3. Risk Profile and Discount Rate

Perceived risk directly impacts the discount rate used to discount future cash flows. A business in a volatile market or with irregular cash flows may have a higher risk adjustment, reducing its present value or discounted cash flow value.

Risk also includes legal, regulatory, and operational uncertainties.

4. Intangible Assets

Intellectual property, proprietary technology, customer relationships, brand equity, and other intangible assets often add significant value, especially in tech and professional service sectors.

These assets may not appear clearly on a balance sheet but play a major role in enterprise value and book value assessments.

5. Historical and Projected Growth

Past results and estimated future cash flows both matter. Strong historical growth, when combined with reliable forecasts, leads to more confident valuation methods like discounted cash flow analysis or income-based formulas.

6. Company-Specific Factors

Unique traits like your market position, business model, customer base, or leadership team can impact perceived current market value. Companies that are highly scalable or have defensible competitive advantages may justify a premium.

The more accurately you assess these factors, the closer your valuation will be to your business’s true market value, helping you plan smarter, sell better, or grow faster.

FAQ:

What is the formula for valuing a business?

The most common formula is:

Business Value = Net Income × Market Multiple

Other models include Discounted Cash Flow (DCF), which uses:

Value = Future Cash Flows ÷ (1 + Discount Rate)^Years

How do I calculate my business valuation?

You can calculate business valuation using three main approaches:

- Asset-Based: Total Assets – Total Liabilities

- Market-Based: Compare to similar businesses sold

- Income-Based: Use projected cash flows and a discount rate

Using a business valuation calculator can help simplify these.

How much is a business that makes $1 million a year worth?

If a business earns $1 million annually, its valuation depends on the industry’s earnings multiple.

Example: If the multiple is 3×, the business might be worth $3 million. Adjustments apply for growth rate, risk, and market trends.

What are the top 3 valuation methods?

The three primary valuation methods are:

- Asset-Based Valuation

- Market-Based Valuation

- Income-Based Valuation

Each method uses different inputs and works best under specific conditions.

How do you calculate the valuation of a company?

Valuation is calculated using formulas like:

- Net Asset Value: Total Assets – Total Liabilities

- Discounted Cash Flow: Sum of Present Value of Future Cash Flows

- Market Comparables: Price of similar businesses in the market

What is a valuation calculation?

A valuation calculation is the process of estimating a business’s worth using financial data such as net income, assets, cash flow, and industry trends. It’s used in mergers, financing, succession planning, and sales.

Conclusion: Know What Your Business Is Worth

Valuing your business isn’t guesswork, it’s strategy. The right valuation method depends on your goals, assets, industry, and future income. Use trusted business valuation formulas like net asset value, discounted cash flow, or market comparables to guide the process.

Whether you’re preparing for a sale or raising capital, combine accurate inputs with the right tools, like a business valuation calculator, to reveal your company’s true market value.

A smart valuation today means better decisions tomorrow.

Matthew Small is the Vice President of Strategic Sales and Alliances at SmartRoom, where he builds partnerships and leads strategic efforts to deliver cutting-edge virtual data room solutions for dealmakers. With a strong background in enterprise sales and channel development, Matthew is passionate about unlocking new growth opportunities and helping clients navigate complex transactions with greater speed, security, and confidence.