Last Updated on November 13, 2025

IP due diligence is the process of reviewing a company’s intellectual property before a transaction like a merger, acquisition, or major investment. The goal is simple, know exactly what IP assets you’re getting, their value, and the risks that come with them.

This means looking closely at patents, trademarks, copyrights, trade secrets, domain names, software, and any know-how that drives the business. A proper diligence review can confirm ownership, check for validity, and identify weaknesses that could affect the deal.

For investors, attorneys, and companies, conducting IP due diligence is critical. It helps mitigate risk, uncover hidden value, and ensure that IP rights are clearly defined, properly transferred, and free of serious infringement concerns before the purchase is final.

What Is IP Due Diligence?

IP due diligence is a focused diligence review of a company’s intellectual property to see what it owns, how strong those IP rights are, and if there are any problems that could affect a transaction.

It’s about more than just listing existing IP assets, it’s about assessing the scope, ownership, and validity of each item in the portfolio. This includes checking that the target company’s IP is properly registered, that there is a proper assignment of rights from creators or employees, and that it’s not infringing on third party IP rights.

Common IP assets reviewed include:

| IP Asset Type | Examples |

| Patents | Inventions, designs, manufacturing processes |

| Trademarks | Brand names, logos, product names |

| Copyrights | Software, creative works, marketing materials |

| Trade Secrets | Formulas, processes, customer lists, proprietary know-how |

| Domain Names | Company or brand web addresses |

The main goal of IP due diligence is to confirm that the IP rights owned by the business are valid, enforceable, and transferable. This analysis helps buyers, investors, and their attorneys decide if the value of the assets justifies the purchase and if the risks are manageable.

Why IP Due Diligence Is Critical in Transactions

When a deal involves intellectual property, skipping or rushing IP due diligence can be costly. For many companies, their most valuable assets are intangible assets like patents, trademarks, software, or trade secrets. If these aren’t protected, clearly owned, or free from disputes, the transaction could lose value fast.

In mergers, acquisitions, and investment deals, the results of a diligence review often influence the purchase price, the terms of the agreement, or even whether the deal goes through at all. A thorough review helps investors and attorneys:

- Confirm the existence and ownership of the target company’s IP

- Identify risks, including infringement issues or unclear representations

- Evaluate the quality and scope of IP rights owned

- Spot weaknesses that could limit development or future use

- Check for third party IP rights that could block products from the market

IP due diligence also provides a clear picture of the strategic value of the portfolio, helping buyers decide if it fits their business and long-term plans. Without it, the deal could be built on assumptions that don’t match reality.

Goals of IP Due Diligence

The main goal of IP due diligence is to understand the value, strength, and risks of the target company’s IP before completing a transaction. This ensures the buyer knows exactly what they’re getting and can plan how to use it effectively after the deal.

A strong diligence review aims to:

- Evaluate value: Determine how the IP assets contribute to the company’s business and market position.

- Assess robustness and scope: Check if the IP rights owned are valid, enforceable, and broad enough to protect products or services.

- Identify risks: Spot ownership disputes, third party IP rights conflicts, or infringement issues.

- Confirm proper assignment: Make sure all patents, trademarks, copyrights, trade secrets, and software are legally transferred to the company.

- Align with strategy: Ensure the portfolio fits the buyer’s development, expansion, or licensing plans.

Done well, this analysis gives investors, attorneys, and corporate teams the information they need to mitigate risks, adjust deal terms, and maximize the value of the purchase.

Steps in the IP Due Diligence Process

A proper IP due diligence review follows a clear, step-by-step approach. Each step is designed to confirm ownership, check for risks, and understand the value of the IP assets before closing a transaction.

1. Gather IP Asset Information

Collect a full list of the target company’s IP, including patents, trademarks, copyrights, trade secrets, domain names, and software.

2. Verify Ownership and Proper Assignment

Make sure all IP rights owned are in the company’s name and that past inventors, employees, or contractors have signed valid transfer agreements.

3. Review Contracts and Agreements

Check licensing, joint development, supplier, and partnership contracts for IP clauses that could limit use or transfer.

4. Analyze IP Filings and Registrations

Review registration certificates, filing dates, and renewal status for patents and trademarks to confirm validity.

5. Conduct Freedom-to-Operate (FTO) Analysis

Assess whether the company’s products or technology might infringe on third party IP rights.

6. Assess Enforceability and Scope

Evaluate whether the IP rights are broad enough to protect the company’s market position and withstand challenges.

7. Review Litigation History

Look at any past or ongoing IP litigation to identify disputes, infringement claims, or settlements.

8. Evaluate Post-Transaction Integration Potential

Determine how the IP portfolio will fit with the buyer’s business, strategy, and development plans.

IP Due Diligence Checklist

A checklist makes it easier to track progress during the diligence review. Use it to confirm that all key IP assets and related documents have been identified, verified, and assessed before finalizing a transaction.

| Category | What to Review |

| Ownership | Registration certificates, proper assignment records, chain of title for patents, trademarks, and copyrights |

| Contracts | Licensing agreements, joint ventures, supplier contracts, employee and contractor IP clauses |

| Filings & Renewals | Patent/trademark filings, renewal dates, proof of fee payments |

| Freedom-to-Operate (FTO) | Search results for third party IP rights that could block products or services |

| Litigation | Past and pending IP litigation, infringement claims, settlement agreements |

| Trade Secrets | Internal policies, NDAs, and security measures to protect trade secrets and proprietary know-how |

| Domain Names & Software | Ownership records, transferability, and license rights for domain names and core software |

A complete checklist helps investors, attorneys, and buyers quickly see if the target company’s IP is protected, transferable, and aligned with the business strategy.

Key Risks to Identify and Avoid

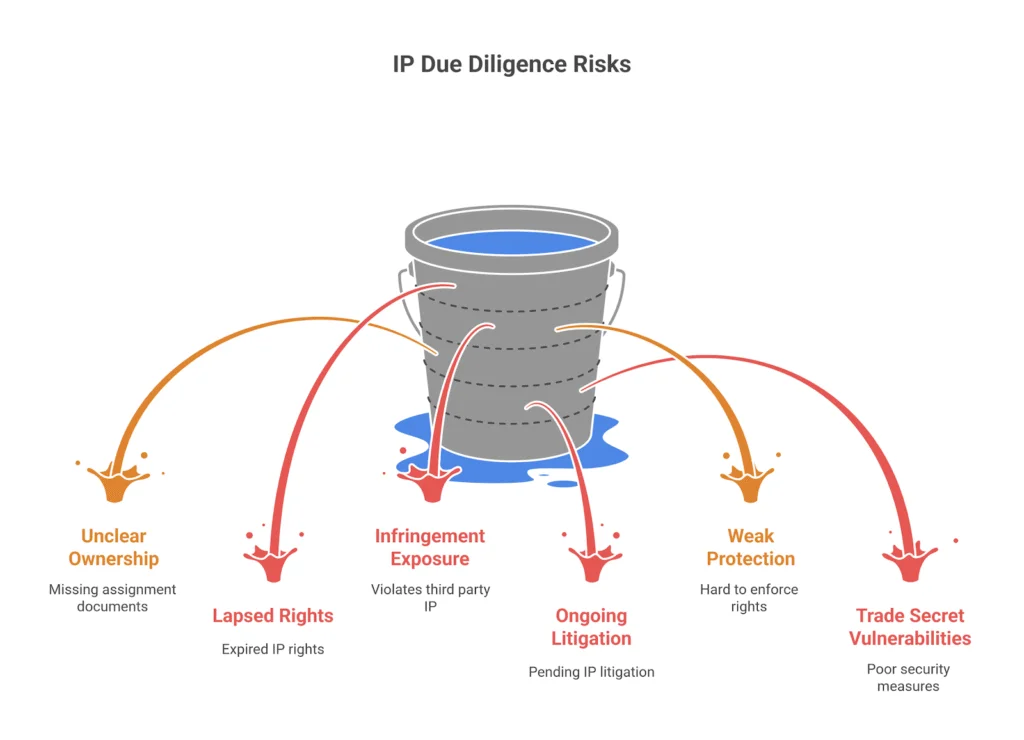

During IP due diligence, spotting risks early can save buyers and investors from costly problems after the transaction closes. Common issues include:

- Unclear ownership: Missing or invalid proper assignment documents from inventors, employees, or contractors.

- Lapsed rights: Expired patents, trademarks, or domain registrations due to missed renewals.

- Infringement exposure: Products or technology that may violate third party IP rights.

- Ongoing litigation: Pending or unresolved IP litigation that could affect the value of the assets.

- Weak protection: Narrow scope of IP rights, making them hard to enforce.

- Trade secret vulnerabilities: Poor security measures or lack of NDAs for confidential know-how.

- Restrictive contracts: Licensing or partnership agreements that limit the buyer’s ability to use the IP.

Identifying these issues during the diligence review allows the buyer’s team and attorneys to address them, adjust the deal terms, or walk away before major damage is done.

Best Practices for Effective IP Due Diligence

A thorough IP due diligence process protects buyers, investors, and companies from overpaying or taking on hidden risks. Following proven practices ensures the diligence review is efficient and complete.

- Start Early: Begin reviewing IP assets as soon as the deal discussions begin. Early findings can shape negotiations and the purchase price.

- Use Experienced Professionals: Engage attorneys or consultants with expertise in patents, trademarks, software, and licensing agreements.

- Go Beyond Registrations: Check ownership, scope, validity, and enforceability, not just the existence of filings.

- Include Freedom-to-Operate Analysis: Confirm the target company’s IP doesn’t infringe on third party IP rights.

- Review Related Contracts: Examine all licensing, development, supplier, and partnership agreements for IP clauses that could affect use or transfer.

- Document Everything: Keep clear records of findings, potential weaknesses, and recommended strategies to mitigate issues.

- Align IP with Business Goals: Ensure the portfolio fits the buyer’s development plans and supports long-term value creation.

Frequently Asked Questions

1. What is an IP due diligence?

It’s the review of a company’s intellectual property before a deal to confirm ownership, validity, and scope, and to spot risks like infringement or unclear rights.

2. What is the IP due diligence list?

A checklist covering patents, trademarks, copyrights, trade secrets, licensing agreements, renewal records, and IP litigation history.

3. What are the three types of due diligence?

- Financial: Reviews money matters like revenue and debt.

- Legal: Checks contracts, compliance, and rights.

- Commercial: Looks at market position and growth potential.

Conclusion

IP due diligence is essential in any merger, acquisition, or investment where intellectual property plays a major role. It confirms the ownership, validity, and scope of the target company’s IP, identifies risks, and uncovers ways to strengthen value. A well-run diligence review examines patents, trademarks, software, trade secrets, domain names, and related contracts to ensure nothing is overlooked.

With the right expertise, buyers and investors can mitigate risks, negotiate better terms, and protect their interests. Done properly, IP due diligence prevents costly surprises and ensures the acquired IP assets contribute to long-term growth and business success.

Matthew Small is the Vice President of Strategic Sales and Alliances at SmartRoom, where he builds partnerships and leads strategic efforts to deliver cutting-edge virtual data room solutions for dealmakers. With a strong background in enterprise sales and channel development, Matthew is passionate about unlocking new growth opportunities and helping clients navigate complex transactions with greater speed, security, and confidence.