While investors might not be noticing, there is a significant shift occurring within the private equity industry — and these changes could benefit the performance of their portfolio. Firms have turned their attention to implementing resources and services to help streamline fund administration processes.

What is private equity fund administration?

Private Equity Fund Administration include functions related to the funds operations including functions such as regulatory and compliance, fund accounting, audit oversight, investor reporting, and tax requirements.

Over the course of the last decade, general partners have been increasingly outsourcing fund administration to third parties. As David Fann, president and CEO of private equity consultant TorreyCove Capital Partners, told Pensions & Investments in 2014, “Due to increased investor requirements for transparency and the need to maintain regulatory compliance, the quality of a private equity firm’s back-office operations has now become critically important.”

Reflecting this trend, in 2017 BNY Mellon estimated that between 20-30 percent of private equity administration was outsourced. Industry analysts predict that number could reach nearly 50 percent by the end of 2018.

The compliance side is just one benefit to outsourcing administration. Another major upside is cost savings and better deployment of resources. Those resources can be allocated toward fund management, potentially delivering better results for investors.

“Outsourcing helps clients focus on what’s important — maximizing investment returns,” Robert Caporale, former head of JPMorgan’s Private Equity Fund Services wrote in a research note.

What does a fund administrator do?

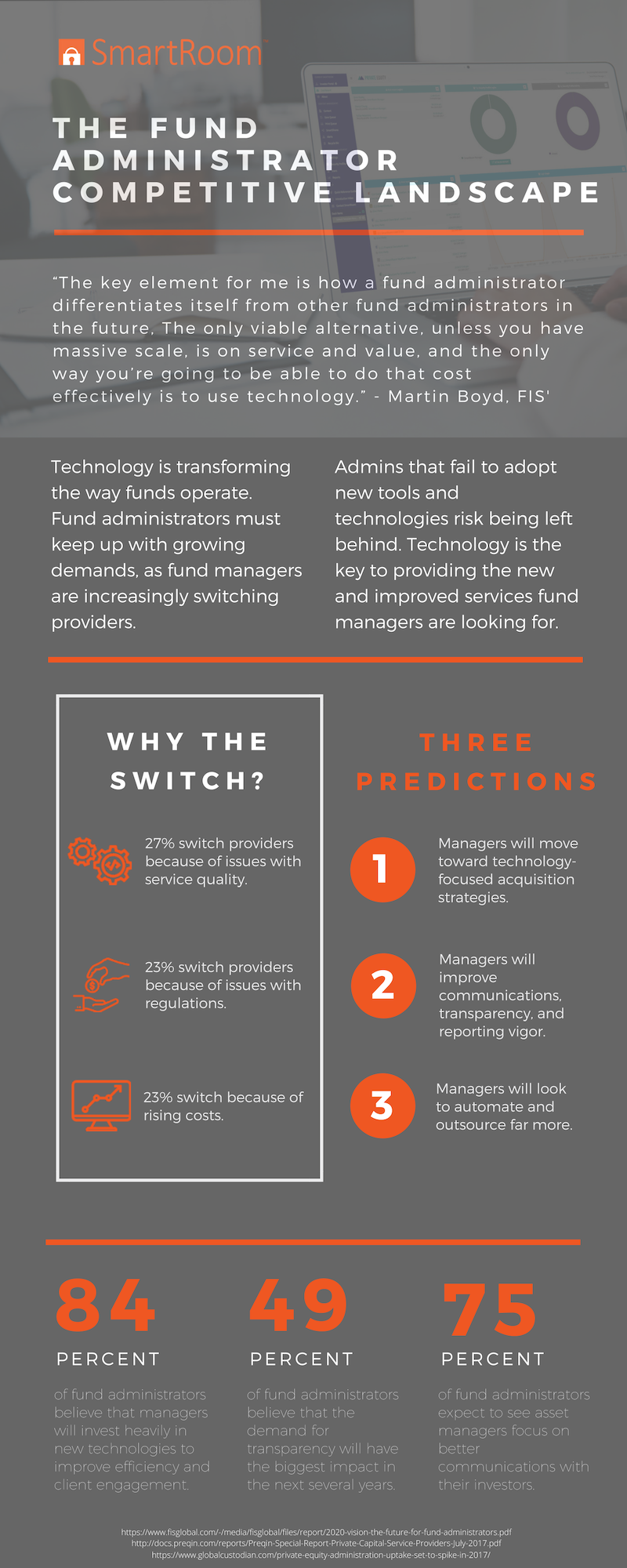

Fund administrators manage day to day back-office operations to ensure the fund runs smoothly. They oversee a number of critical functions so it’s crucial to find the right fund administration services partner to outsource to. According to a 2017 survey conducted by Prequin, 36 percent of fund managers changed their management company during the previous calendar year. In fact, more than 40 percent of these administrators are up for review annually. According to the study, the following are three top reasons people move on:

- Quality of services (27 percent) – As with most industries, services are critical to attracting and maintaining clients. Those servicing private equity firms are not immune from this as the PE firms and their investors demand high touch and robust offerings. Included among that is investor reporting.

Investors are increasingly sophisticated thanks to the volume of information now available to them. With this, the onus is on administrators to provide detailed and customized reports (as well as notes, statements and otherwise) that are ILPA-compliant.

- Cost (23 percent) – Despite the fact that trillions of dollars are under management, money matters when it comes to fund administration. Margins need to be made, services need to be provided. This and everything else that goes into fund administration costs money. So keeping these costs down can help keep management fees down, enabling these savings to be passed along to investors.

- Regulatory Concerns (23 percent) – The regulatory landscape is continually evolving. With that it’s important to have personnel and resources in place that understand ILPA requirements. Any changes in these guidelines require communications to customers, and these costs can adversely impact margins. So having a provider in place that understands how to cost-efficiently implement and communicate regulatory changes is key.

Another reason that drives change is overall technology. Technology is all around us – from our phones to our televisions to our cars and even light switches. So having leading-edge technology supporting fund administration seems like a no-brainer.

“The way to derive more opportunity is a combination of technology and process whereby you commoditize and scale the every day,” believes FIS’ Tony Warren. “When technology tools are centered around exception management and workflow, automating standard processes, it elevates the role of the fund administrator. Freed up to work with asset managers on more complex scenarios, administrators can begin to take on the role of a business partner and add value at the service level.”

Unfortunately, not every fund administrator recognizes this. According to a 2016 FIS Global study, 89 percent of administrators anticipate having to make “significant” or “moderate” changes to their systems and technology by 2020. And 27 percent said they have no data analysis tools at all with another 28 percent saying they only have “basic data analysis tools.”

Cloud technologies are growing in importance too, emphasizes Tony Warren of FIS. “From an asset manager’s perspective, they want to be able to do what they do best rather than worry about the technology, so installing vendor software on site makes less sense,” he says. “Instead, they’re exploring the hosted model.”

To meet these growing demands of GPs, investment funds are beginning to partner with third-party secure cloud-based technology solutions. Companies like SmartRoom offer a number of secure solutions specifically designed to automate investor reporting and help manage limited partnership transparency and compliance.

SmartRoom’s investor portal, SmartLP, is a cloud-based platform that allows funds to automate the customization and distribution of investor documents, and then allows investors to access those documents in a secure, centralized hub. In short, SmartLP combines the automation of report creation with a simple intuitive online experience for today’s investors.

“There is high demand for an investor portal,” says Northern Trust’s Peter Cherecwich. “We’re talking about state-of-the-art tools that provide detailed information and give the asset manager the ability to pick and choose what level of transparency they want and how often they want it.”

Furthermore, SmartLP, is fully integrated with the company’s leading next-generation virtual data room. SmartRoom offers an annual flat-fee pricing model that allows funds unlimited data and rooms for all their use cases including fundraising, portfolio company exits, add-on acquisitions, portfolio company collaboration, and lender communication.

By partnering with companies like SmartRoom and offering their secure software solutions, fund administrators can easily meet the growing demands of GP’s. SmartRoom’s fully customized, integrated data management solutions help streamline workflow and automate processes for fund managers. Offering solutions like SmartRoom will give fund administrators a leg up from the competition, reduce costs and address investor transparency, and compliance for their clients.