Every once in a while, something is said about business that’s so on point that it’s hard to phrase it in any other way. In this case, it’s KPMG with their recent report “The digital transformation imperative.” The consulting firm writes:

“If you’re running or working for a private equity firm and you haven’t taken bold steps to integrate the latest digital tools and data and analytics (D&A) technology into your business, you may be working with a built-in expiration date.”

Considering the growth and advancements in technology, it’s hard to argue that statement. And with the amount of cash flowing into these private equity opportunities ($57 billion in Q1-2018), this is clearly a high-stakes world with little margin for error. Private equity firms are increasingly leveraging technology for all stages of investment from pre-deal assessments to post-deal optimization to exits and overall operations. So what are the key areas that private equity firms should be focusing on when it comes to technology investment and what are the benefits they deliver?

Private Equity Technology Trends

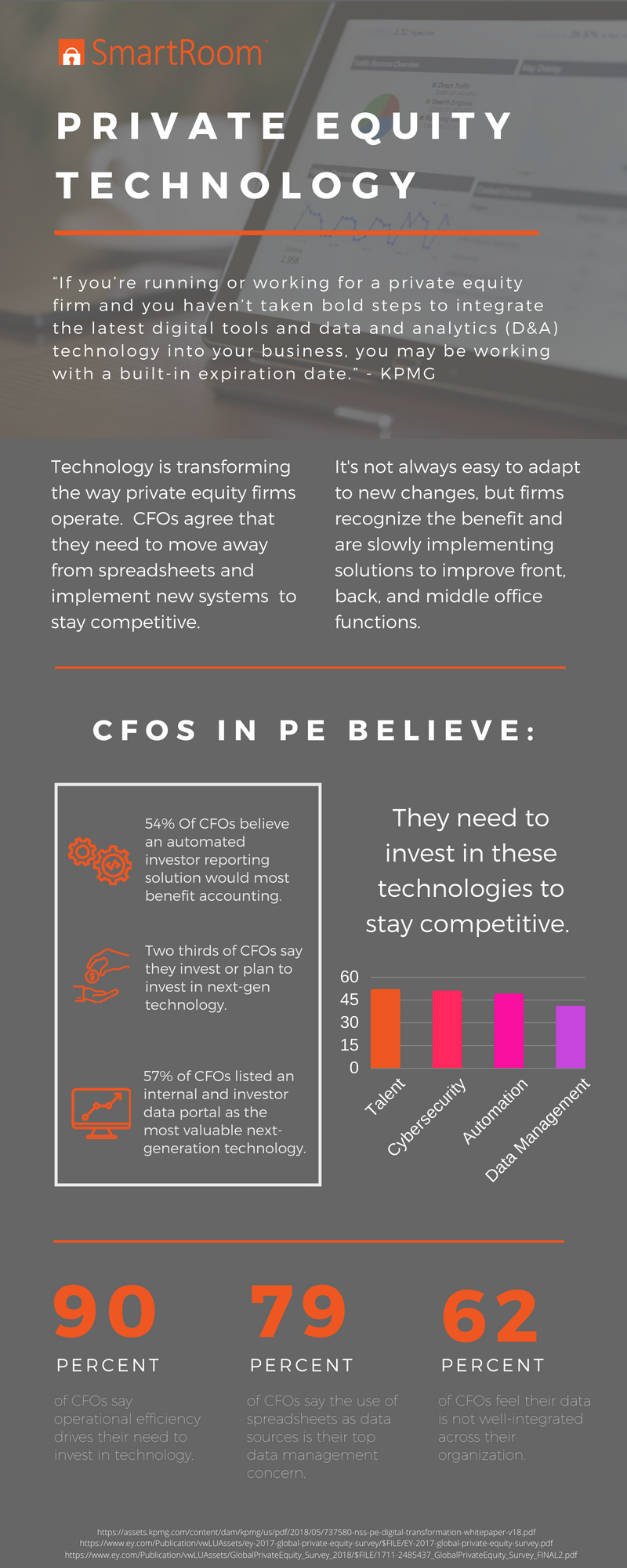

SmartRoom’s 2018 Private Equity Technology Infographic

Technology is transforming the way private equity firms operate. CFOs agree that they need to move away from spreadsheets and implement new systems to stay competitive. It’s not always easy to adapt to new changes, but PE firms recognize the benefit of of investing in private equity software and are slowly turning to technology companies to implement management solutions to improve front, back, and middle office functions.

In their report, KPMG notes that users of digital tools and analytics technology “have witnessed improvements in their deal-making process as well as increased operational efficiencies in their portfolio companies.” This sentiment is echoed by one of KPMG’s competitors. In EY’s 2017 Global Private Equity Survey, the firm found that 90 percent of private equity CFOs responding said “Operations Efficiency” drives their need to invest in technology. Additionally 65 percent said “Regulatory Requirements.” These same CFOs, when asked about what they needed to be competitive in the future, listed “Data Management” fourth on their list of concerns, trailing only “Retaining Talent,” “Cybersecurity” and “Automating Manual Processes.” One of the tools that can help achieve these goals is a virtual data room.

According to the KPMG report, many private equity firms “have also implemented platforms that offer virtual data rooms [so] limited partners can access data in real time, check risk positions, and do scenario analysis.” They go on to note that VDRs can help “generate alpha…or even mitigate risk.”

Private Equity Software Solution Package

One of these tech companies that is leading the development and investment in management software for the modern private equity firm is SmartRoom. They have also introduced an entire PE technology package with technology solutions including a virtual data room and investor portal designed specifically for private equity firms to streamline and accelerate information sharing and content management across all office functions of their fund.

- Virtual Data Room – SmartRoom offers their industry-leading VDR at a flat-rate for PE firms to use for multiple use cases. For one annual fee firms have access to unlimited data to use for portfolio divestitures, fundraises, add-on acquisitions, lender communication and more.

- SmartLP – This service combines the automation of report creation with a simple intuitive online investor portal for today’s limited partners. SmartLP™ portal is a cloud-based platform that allows your fund to automate the customization and distribution of investor documents and then allows investors to access those documents in a secure, centralized hub.

- Deal Management – SmartRoom has partnered with DealCloud to bring client’s their cloud-based CRM specifically designed to support the day-to-day execution needs for PE firms and principle investors.

For more information on SmartRoom’s Private Equity solutions bundle visit: https://smartroom.com/private-equity/