Last Updated on October 15, 2025

In today’s hyperconnected, data-driven business world, virtual data rooms (VDRs) are no longer optional, they’re indispensable for high-stakes collaborations. The global market for virtual data rooms is already valued in the billions, and is forecast to grow rapidly as more businesses shift from physical data rooms to secure, cloud-based environments.

When two or more companies enter into a joint venture, they typically must share sensitive information, proprietary intellectual property, and sensitive business documents with external parties, all while protecting themselves from data breaches, regulatory exposure, and leaks of competitive advantage. A data room for joint ventures becomes the backbone for managing that exchange securely and efficiently.

This guide walks you through why VDRs are essential in the joint venture context, how they support the due diligence process, how to safeguard document security and compliance, and how to choose the right data room provider. Each section is designed to help you understand not just what to do, but why it matters, especially for complex business transactions that span borders, industries, and regulatory regimes.

What Is a Virtual Data Room (VDR)?

A virtual data room (VDR) is a secure environment where companies store and share sensitive information during business transactions. Think of it as the digital evolution of physical data rooms, replacing stacks of physical documents with an online space that is widely accessible to authorized users across different time zones.

Instead of flying executives or legal teams to one location, a VDR lets multiple people access and review documents at the same time. This makes it an attractive alternative for today’s global strategic partnerships and joint ventures.

Why Companies Use VDRs

- Protect sensitive data with advanced data encryption.

- Restrict document access through permissions and two-factor authentication.

- Apply document watermarks and version control for transparency.

- Generate compliance reports for regulators and board members.

A good virtual data room doesn’t just hold files. It supports the entire deal process, from the early stages of a joint venture, through the diligence process, and into final negotiations.

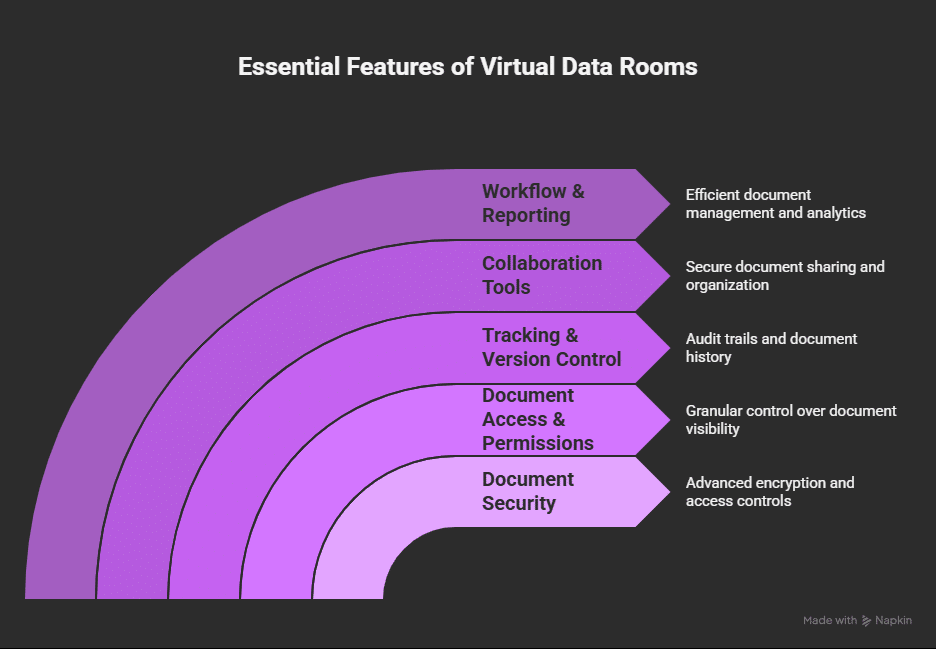

Key Features of Virtual Data Rooms

A virtual data room VDR is more than just online storage. It’s built to help companies manage sensitive information and critical documents in a way that’s both secure and practical. Below are the key features that set a good virtual data room apart.

1. Document Security

Modern VDR providers use advanced data encryption and two-factor authentication to protect sensitive data. Features like document watermarks, restricted downloads, and even self-destructing files give businesses more control over who sees what. This level of document security is essential for business transactions under increased scrutiny.

2. Document Access & Permissions

Not every stakeholder should see everything. A strong VDR offers detailed document access settings that allow companies to grant or limit visibility to interested parties, external stakeholders, or even specific board members. These permission layers ensure proprietary information remains safe while still making key information available for decision making.

3. Tracking & Version Control

One of the overlooked features of VDRs is their ability to track every action. With built-in version control, businesses can review who opened which documents, when they did it, and what changes were made. These audit trails can be exported as compliance reports, helping legal teams demonstrate that the process followed proper rules.

4. Collaboration Tools

In a joint venture, multiple people from different organizations often need to share documents quickly. VDRs allow secure document sharing in a structured environment, where folders keep everything organized and external parties can safely engage. This makes the platform an attractive alternative to back-and-forth emails that risk losing sensitive business documents.

5. Workflow & Reporting

VDRs don’t just store files, they improve workflows. Bulk uploads, smart indexing, and search functionality mean documents are easier to manage. At the same time, built-in analytics help businesses measure deal value, generate compliance reports, and support faster decision making during negotiations.

VDRs vs. Traditional Cloud Storage

At first glance, a virtual data room and a cloud storage tool might seem similar. Both allow users to upload and share documents online. But when it comes to high-stakes business transactions like a joint venture, the differences are significant.

Security & Control

- Cloud storage is designed for convenience, not for handling sensitive business documents.

- A virtual data room VDR, on the other hand, uses data encryption, two-factor authentication, and document watermarks to protect sensitive data.

- VDRs also give companies granular control over document access, something basic cloud platforms can’t match.

Compliance & Reporting

- Global businesses involved in cross-border collaborations face strict regulations like GDPR or CCPA.

- Cloud platforms rarely generate compliance reports or detailed review logs.

- A data room provider builds these tools in, giving legal teams a clear audit trail and reducing risk during the due diligence process.

Collaboration & Efficiency

- Cloud storage can work for simple document sharing, but it lacks a structured environment for complex deals.

- VDRs simplify the diligence process by categorizing folders, enabling version control, and allowing multiple people to access the same files without overlap.

- For strategic partnerships that span time zones and involve external parties, VDRs are the more secure and efficient option.

| Aspect | Traditional Cloud Storage | Virtual Data Rooms (VDRs) |

| Security & Control | Built for convenience, not designed to protect sensitive business documents. Limited control over document access. | Advanced data encryption, two-factor authentication, and document watermarks. Granular control over who can view or edit files. |

| Compliance & Reporting | Rarely generates compliance reports or detailed review logs. Limited support for legal teams. | Generates full compliance reports and audit trails. Helps companies reduce risk in the due diligence process. |

| Collaboration & Efficiency | Works for simple document sharing, but lacks a structured environment for complex deals. No version control. | Organized folders, built-in version control, and simultaneous access for multiple people across time zones. VDRs simplify the diligence process. |

VDRs vs. Traditional Cloud Storage

Why Virtual Data Rooms Matter in Joint Ventures

A joint venture brings two or more companies together to pursue a strategic partnership while keeping their independence. These deals often involve sensitive information, proprietary information, and sensitive business documents that must be shared securely. That’s where a data room for joint venture becomes essential.

Joint Ventures vs. Mergers

A joint venture is different from a merger. In a merger, two businesses involved fully combine operations. In a JV, each partner retains autonomy but collaborates on a specific project or entry into new markets. This structure allows them to share risk, pool expertise, and increase deal value without losing their identity.

Advantages of Using VDRs in Joint Ventures

- Better Security

A virtual data room VDR creates a secure environment where sensitive data is locked behind two-factor authentication, data encryption, and document watermarks. - Simplified Communication

Instead of scattered emails, all documents are stored in one structured environment, making it easier for users and external parties to share documents efficiently. - More Efficient Due Diligence

During the diligence process, VDRs allow legal teams and other interested parties to access large volumes of information quickly. This saves time and reduces errors compared to handling physical documents. - Effortless Regulatory Compliance

With built-in compliance reports, a data room provider helps companies stay on top of complex rules in cross-border collaborations. - Centralized Access for Multiple People

Partners, advisors, and even board members can work together from different time zones. This centralized document access ensures critical information is always available for faster decision making.

The Role of VDRs in Due Diligence

The due diligence process is at the heart of most business transactions. Whether a joint venture, merger, or initial public offering, both sides need access to large volumes of sensitive data to verify financial health, legal compliance, and operational strength. Traditionally, this was done through physical data rooms, where teams spent weeks sorting through physical documents. Today, a virtual data room makes that process faster, safer, and more reliable.

Why Due Diligence Matters

- Ensures companies can review financial records, contracts, and obligations before committing.

- Helps identify risk, such as hidden liabilities or regulatory issues.

- Creates transparency for interested parties, including external stakeholders, investors, and legal teams.

- Directly impacts deal value and the speed of decision making.

How Virtual Data Rooms Simplify the Diligence Process

- Centralized Access: All documents are stored in one structured environment, allowing multiple people to work simultaneously.

- Version Control: Every update is logged, reducing errors and confusion during the review phase.

- Compliance Reports: Automatic tracking generates audit-ready evidence for regulators.

- Secure Sharing: With document access controls, companies can limit visibility to only those who need it.

Benefits for Joint Ventures

In a data room for joint venture, partners from different time zones can share documents without delay. This prevents bottlenecks and ensures critical information is always available. By using a virtual data room VDR, the entire diligence process becomes smoother, supporting faster negotiations and reducing the chance of missed red flags.

Document Security and Compliance in Data Rooms

Security and compliance are the biggest reasons companies choose a virtual data room over traditional tools. In business transactions like a joint venture or initial public offering, leaking sensitive business documents or mishandling proprietary information could destroy deal value. A strong data room provider reduces this risk by creating a secure environment where every step is controlled, tracked, and verified.

Core Security Features

- Data Encryption: Protects sensitive data both in transit and at rest, preventing data breaches.

- Two-Factor Authentication: Ensures that only verified users gain access.

- Document Watermarks: Deter unauthorized sharing of files by marking every page.

- Document Access Restrictions: Limit copying, downloading, or printing to control how documents are used.

Compliance Tools

- Compliance Reports: Automatically generated to help legal teams prove adherence to GDPR, CCPA, or local data protection laws.

- Audit Trails: Track every login, review, and action, creating transparency for interested parties and board members.

- Jurisdictional Data Storage: Keep sensitive information in the right location to satisfy cross-border regulations.

A data room for joint venture often involves cross-border collaborations where regulations differ. Without strict document security, companies risk losing intellectual property or exposing sensitive information to external parties. By storing critical information in a structured environment, partners can build trust while ensuring legal integrity.

Use Cases of Virtual Data Rooms Beyond Joint Ventures

While a data room for joint venture is one of the most common applications, the benefits of a virtual data room extend far beyond partnerships. Any situation that requires secure document sharing, regulatory oversight, or collaboration between companies can be streamlined with a VDR.

Mergers and Acquisitions (M&A)

The due diligence process in M&A often involves large volumes of sensitive data. A virtual data room VDR helps interested parties and legal teams review documents quickly, track changes with version control, and generate compliance reports that regulators require.

Initial Public Offerings (IPOs)

During an initial public offering, companies must disclose sensitive business documents to regulators, investors, and board members. A VDR ensures document security, provides a structured environment for files, and allows multiple people to collaborate across time zones without exposing sensitive information.

Audits and Regulatory Reviews

Audits require strict organization and full transparency. VDRs simplify this process by categorizing folders, restricting document access, and providing detailed review logs. Automatic compliance reports reduce the burden on internal legal teams while ensuring critical information is accessible to auditors.

Investor and Board Communications

When dealing with external stakeholders like investors or board members, companies need a secure environment to share documents and key information. With tools like two-factor authentication and data encryption, a VDR helps maintain confidentiality while supporting informed decision making.

Choosing the Right Data Room Provider

Not every data room provider offers the same level of security, features, or ease of use. When evaluating options, companies should focus on:

- Strong document security tools like data encryption, document watermarks, and two-factor authentication.

- The ability to generate detailed compliance reports and maintain full audit trails.

- A structured environment that supports multiple people working across time zones and handling sensitive information.

- Scalable features for different business transactions, from joint ventures to initial public offerings.

Why Consider SmartRoom?

If you’re looking for a good virtual data room that balances power with usability, SmartRoom is an attractive alternative. Designed to handle the entire deal process, SmartRoom helps companies:

- Protect sensitive data with enterprise-grade encryption and strict document access controls.

- Simplify the due diligence process with smart organization, version control, and review tools.

- Provide a secure environment for strategic partnerships, including cross-border collaborations where compliance and risk management are critical.

- Share critical information efficiently with external stakeholders, board members, and other interested parties without compromising proprietary information.

Whether your organization is entering a joint venture, preparing for an IPO, or managing ongoing business transactions, SmartRoom’s VDR platform delivers the features you need to keep sensitive data secure and make faster, smarter decision making possible.

FAQs: Data Rooms for Joint Ventures

1. What is the difference between a virtual data room and cloud storage?

A virtual data room VDR is built for business transactions that involve sensitive data and proprietary information. Unlike standard cloud storage, a VDR includes document security tools such as two-factor authentication, document watermarks, and data encryption. It also produces compliance reports and supports the due diligence process, making it far more reliable for joint ventures or strategic partnerships.

2. How secure are virtual data rooms?

Modern VDR providers use enterprise-grade encryption, layered document access controls, and audit trails to protect sensitive data. Some platforms also include features like version control, restrictions on copying or downloading, and automatic compliance reports. This creates a secure environment that reduces the risk of data breaches.

3. Can small companies use a data room for a joint venture?

Yes. A data room for joint venture isn’t just for large corporations. Even smaller companies benefit when sharing sensitive information with external stakeholders or partners. A VDR gives them the ability to organize files, maintain control, and collaborate with interested parties in a structured environment.

4. How do VDRs help with compliance?

During the diligence process, compliance can be overwhelming, especially in cross-border collaborations. A good virtual data room simplifies this by automatically generating compliance reports, logging all review activity, and ensuring critical information stays within the right jurisdiction. This is essential for audits, initial public offerings, and international strategic partnerships.

5. What industries benefit the most from virtual data rooms?

While data rooms are widely used in M&A and joint ventures, industries like tech, pharmaceuticals, and energy rely heavily on them to protect intellectual property and manage large volumes of sensitive business documents. Financial services also use VDRs during audits, negotiations, and fundraising to maintain document security and improve decision making.

Conclusion

Managing a joint venture successfully requires more than just a legal agreement. It depends on how well companies handle sensitive information, keep proprietary information protected, and make sure every interested party has the right level of document access. A virtual data room makes this possible by creating a secure environment where partners can share documents, maintain control, and move through the due diligence process with fewer delays.

Unlike outdated physical data rooms, modern VDRs are built for global collaboration. They give legal teams, advisors, and even board members the tools they need to work across time zones, track progress with version control, and reduce risk during negotiations. The result is faster decision making, smoother workflows, and stronger outcomes for the businesses involved.

For any organization exploring a strategic partnership or preparing for complex business transactions, a good virtual data room is no longer optional, it’s the standard.

Matthew Small is the Vice President of Strategic Sales and Alliances at SmartRoom, where he builds partnerships and leads strategic efforts to deliver cutting-edge virtual data room solutions for dealmakers. With a strong background in enterprise sales and channel development, Matthew is passionate about unlocking new growth opportunities and helping clients navigate complex transactions with greater speed, security, and confidence.