Last Updated on October 8, 2025

Modern businesses rely on a wide network of third-party relationships, from vendors and suppliers to consultants and technology providers. These external parties often bring expertise and efficiency, but they also introduce risks that can impact compliance, operations, and reputation.

When third-party due diligence is missing or poorly managed, companies face greater exposure to regulatory action, financial penalties, and reputational damage. Even one vendor with weak controls or hidden compliance issues can create consequences that ripple across the business.

This guide explains what third-party due diligence is, why it matters, and how organizations can build a practical due diligence process that helps them mitigate risks, protect customer data, and keep their supply chain stable.

What Is Third-Party Due Diligence?

Third-party due diligence is the structured process of evaluating and monitoring external parties a business works with, such as vendors, suppliers, consultants, or distributors. The goal is to identify and mitigate risks tied to compliance, ethics, operational integrity, and financial stability before and during the relationship.

Unlike a one-off check, an effective due diligence process goes deeper than simply verifying a company’s registration or ownership. It involves assessing a partner’s financial health, legal history, and reputation, along with their vendor’s security posture and ability to safeguard customer data. For financial institutions and regulated industries, this kind of review is critical to ensuring business partners meet the same standards required by law and regulators.

At its core, third party risk management depends on this diligence. Without it, organizations open themselves up to operational risks, compliance risks, and reputational damage from the actions of others. With it, companies can build stronger vendor relationships, protect their brand, and ensure their external partners align with their strategic goals.

Why Third-Party Due Diligence Matters

Every organization depends on third-party relationships, but those same connections can quickly turn into liabilities if not properly vetted. A single third party vendor with poor financial health, a history of compliance issues, or a weak security posture can undo years of work in building trust and stability. That’s why a structured due diligence process is essential for protecting both operations and reputation.

- Spot potential risks early, uncover financial instability, operational risks, and gaps in a partner’s compliance record before they cause damage.

- Avoid regulatory action and penalties, enforcement agencies often hold companies accountable for the actions of their business partners, even when violations come from external parties.

- Prevent data breaches, assessing how vendors handle customer data reduces exposure to cybersecurity breaches and privacy violations.

- Keep the supply chain resilient, strong due diligence makes the entire vendor lifecycle more reliable, ensuring continuity even when one partner falls short.

- Set the same standards for all partners, by holding third-party relationships to your internal compliance, ethical, and operational requirements, you create consistency across your network.

- Support long-term strategic goals, working only with vetted, trustworthy partners ensures vendor decisions align with wider business objectives.

- Mitigate human rights and ethical risks, modern regulations and investor expectations demand attention to issues like human rights, corruption, and environmental impact.

Third-party due diligence isn’t just about avoiding fines, it’s about building a stronger, more trustworthy business that can withstand challenges and deliver on its promises.

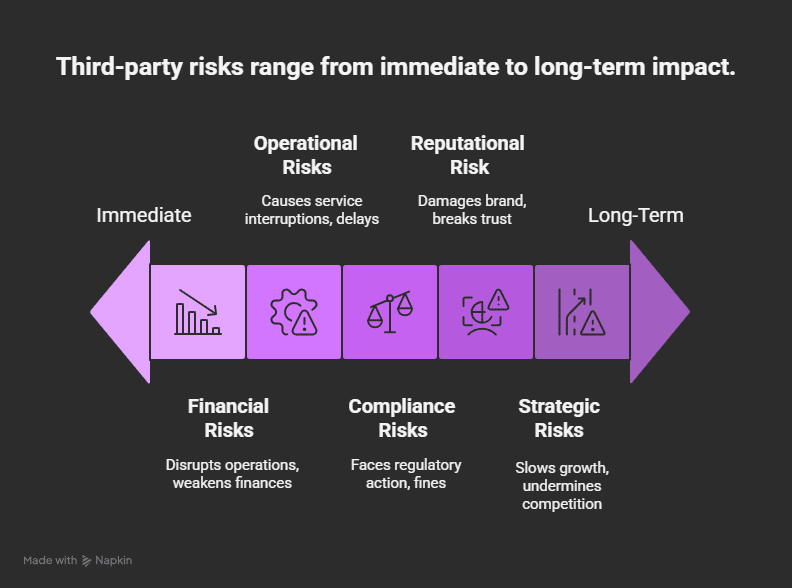

What Are Third-Party Risks?

Working with external vendors, consultants, and service providers brings opportunity, but it also introduces risks that organizations must identify and control. The main categories of third party risk include:

Financial Risks

A third party vendor struggling with debt, poor cash flow, or unstable funding can create direct problems for your business. Missed deadlines, contract failures, or unpaid obligations may disrupt operations and weaken your financial position.

Reputational Risk

The actions of a vendor can directly impact your brand. Associations with fraud, unethical labor practices, or corruption can lead to severe reputational damage. Once trust is broken, rebuilding it often takes years.

Compliance Risks

If external parties fail to follow regulations, whether related to anti-bribery, human rights, or data privacy, your company may face regulatory action, fines, or even litigation. For financial institutions, these risks are especially high.

Operational Risks

Weak internal processes, limited resources, or an inadequate vendor’s security posture can cause service interruptions, supply delays, or a cybersecurity breach. These risks ripple through the supply chain and affect daily business continuity.

Strategic Risks

Not every partner will align with your company’s strategic goals. If their long-term direction, methods, or values clash with yours, the relationship can slow growth, increase costs, and undermine competitive positioning.

Third-Party Risk Management Explained

Third-party risk management (TPRM) is the framework companies use to analyze, monitor, and control the risks that come with working alongside external vendors, suppliers, and contractors. Instead of treating every vendor the same, businesses use a risk-based approach, applying more scrutiny to high-risk partners while streamlining checks for low-risk ones.

At the heart of any risk management program is visibility. Companies must keep an up-to-date vendor inventory, document the vendor assessment process, and regularly update it as part of the vendor lifecycle. This ensures that no partner slips through the cracks, especially when new vendors are onboarded.

An effective TPRM program balances time and resources with the complexity of managing external parties. It helps organizations:

- Assess third party risk consistently across all partners

- Build structured vendor risk assessments to evaluate financial health, compliance record, and security posture

- Apply enhanced due diligence to partners with a higher risk level

- Document findings and keep detailed records for audits and governance reviews

- Reduce exposure to compliance issues, operational risks, and strategic risk

By embedding these practices, many organizations not only protect themselves from associated risks but also improve collaboration with other departments and manage vendors more effectively.

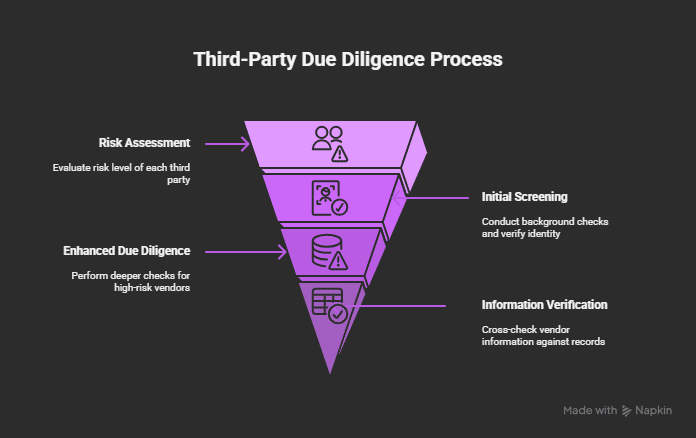

How to Conduct Third-Party Due Diligence (Step-by-Step)

A structured due diligence process ensures that risks are identified, measured, and managed before they can disrupt your business. Here’s how companies can approach third-party due diligence in practical steps:

Step 1: Risk Assessment

Start by evaluating the risk level of each third party. Not all partners present the same exposure, a payment processor handling sensitive customer data carries more risk than a low-volume office supplier. This risk-based approach allows companies to tier vendors, focusing enhanced due diligence on high-risk partners while applying lighter checks for low-risk ones.

Step 2: Initial Screening

Conduct background checks to verify a vendor’s identity, ownership, and history. Screening should include financial health, legal compliance record, and operational capability. For regulated sectors, this may also involve reviewing the vendor’s security posture and ability to protect against data breaches.

Step 3: Enhanced Due Diligence

When working with high-risk vendors, basic screening is not enough. Enhanced due diligence digs deeper with financial audits, reputational inquiries, and checks for corruption, sanctions, or human rights violations. In some cases, it may involve on-the-ground research or independent verification in local languages to uncover hidden red flags.

Step 4: Verification of Information

Cross-check the information provided by vendors against reliable databases and public records. This step ensures accuracy and prevents fraud. Verification often covers compliance with regulatory frameworks, checks for past compliance issues, and an evaluation of cybersecurity standards.

Step 5: Decision and Documentation

Once the review is complete, decide whether to move forward, apply risk-mitigation measures, or decline the partnership. Every decision should be backed by detailed records to create an audit trail. Good contract management also comes into play here, with clear clauses outlining responsibilities and escalation procedures.

Ongoing Monitoring and Continuous Due Diligence

Third-party due diligence doesn’t end once a new vendor is approved. Risks evolve, regulations change, and a once-reliable partner can quickly turn into a liability. That’s why companies need ongoing monitoring throughout the entire vendor lifecycle.

Continuous oversight allows organizations to:

- Run regular assessments that highlight new red flags or hidden compliance issues

- Track shifts in a vendor’s financial health, ownership structure, or vendor’s security posture

- Use real-time monitoring tools to spot early signs of a cybersecurity breach or data breach

- Reassess risk tiers as third party relationships change, for example, when a vendor takes on more critical operations or begins handling sensitive customer data

- Save the team valuable time by automating alerts and integrating updates into the broader risk management program

The goal is to manage third party risk dynamically, not just at onboarding. By adapting the due diligence process to reflect current conditions, companies ensure their business partners continue to meet the same standards expected from day one.

Key Areas to Evaluate in Third-Party Due Diligence

When carrying out a due diligence process, organizations need to go beyond surface-level checks. A thorough review covers multiple dimensions of a third party vendor’s stability, reputation, and compliance posture. The most important areas include:

Financial Health

Assess whether the vendor is financially stable enough to deliver long-term. Poor liquidity or debt can raise red flags and increase potential risks of disruption.

Operational Capability

Look at whether the vendor has the resources, processes, and staff to meet your strategic goals. Weak operations often lead to delays, errors, or other operational risks.

Cybersecurity and Data Protection

Review the vendor’s security posture, including how they handle sensitive customer data. A lack of controls increases the chance of a data breach or cybersecurity breach.

Compliance and Legal History

Check for past compliance issues, sanctions, or violations of regulatory requirements. This is especially critical for financial institutions and highly regulated industries.

Reputation

Investigate how the vendor is viewed in the market. Negative press, poor labor practices, or unethical behavior may cause severe reputational risk for your company.

Ultimate Beneficial Ownership (UBO)

Identify who truly controls the vendor. Hidden ownership structures or connections to external parties with poor records may raise serious risk concerns.

By assessing these key areas, businesses can mitigate risks early and ensure that their vendor relationships are aligned with both compliance requirements and broader risk management programs.

Benefits of Effective Third-Party Due Diligence

When organizations invest in a structured due diligence process, they do more than check a compliance box, they build resilience into their operations. Some of the key benefits include:

- Protection from Financial Loss and Legal Liabilities

By uncovering potential risks early, companies can avoid contracts with unstable vendors or those likely to cause disputes. This reduces exposure to lawsuits, penalties, and financial setbacks.

- Stronger Supply Chain Resilience

A well-executed diligence framework strengthens the entire supply chain. By filtering out weak or unreliable vendors, businesses ensure operational continuity and stability, even during disruptions.

- Safeguarding Reputation

Proactive checks reduce reputational risk by preventing associations with vendors that might generate negative headlines or compliance issues. Protecting trust is just as critical as protecting assets.

- Alignment with Strategic Goals

An effective third party program ensures that every partner supports your long-term strategic goals. This alignment makes it easier to grow responsibly while reducing the chance of misaligned partnerships.

- Better Vendor Relationships

Transparent expectations and clear oversight create stronger vendor relationships. Companies and their business partners operate with shared trust, accountability, and the same standards.

Best Practices for Third-Party Due Diligence

Many organizations still treat third-party due diligence as a box to tick during onboarding. In reality, it should be an ongoing, dynamic effort that fits into the broader risk management program. Below are best practices that help businesses mitigate risks, strengthen vendor relationships, and build long-term resilience.

Take a Risk-Based Approach

Not all vendors are equal. A small supplier of office materials doesn’t need the same level of scrutiny as a third party vendor handling sensitive customer data. By categorizing partners into risk tiers, low, medium, or high risk, companies can adjust the due diligence process accordingly. This ensures enhanced due diligence resources go where they are most needed while lighter checks are applied to low risk partners.

Build a Structured Vendor Assessment Process

A strong vendor assessment process should run through the entire vendor lifecycle. This starts with onboarding a new vendor, continues with regular assessments, and ends with structured offboarding. Documented policies keep checks consistent across the organization and prevent gaps that could expose the business to compliance issues or other associated risks.

Prioritize Cybersecurity and Data Protection

As reliance on digital systems grows, vendors often have access to sensitive systems and customer data. Reviewing a vendor’s security posture is no longer optional. Questions should cover access controls, incident response plans, and protections against cybersecurity breaches or data breaches. This step protects both compliance and reputation.

Strengthen Contract Management

Contracts are one of the strongest tools for managing third party risk. Effective contract management should clearly define responsibilities, include rights to audit, and set expectations for ongoing monitoring. Clauses that outline penalties for non-compliance or failure to meet same standards help reduce surprises later.

Leverage Technology for Continuous Monitoring

Manual reviews can’t keep up with the volume of risks today. TPRM software and automated real time monitoring tools save teams valuable time while improving accuracy. These tools can flag red flags, track changes in a vendor’s status, and help maintain detailed records for audits or regulatory reviews.

When combined, these practices turn due diligence from a one-time task into a living, evolving risk management program. That shift helps organizations not only mitigate risks but also turn their business partners into trusted, long-term allies.

FAQ

What is third-party due diligence?

Third-party due diligence is the process of evaluating and monitoring external vendors, suppliers, or partners to identify and mitigate risks. It typically involves checking financial health, compliance history, cybersecurity posture, and reputation to ensure they meet the same standards as your business.

What are the red flags for third-party due diligence?

Unclear ownership structure or hidden external parties

History of compliance issues, corruption, or sanctions

Weak vendor’s security posture leading to risk of a data breach

Financial instability or inconsistent reporting

Negative media coverage that signals reputational risk

Refusal to provide detailed records during the due diligence process

How can you perform due diligence of a third party?

You can perform third-party due diligence by:

Assessing the risk level of each vendor (low vs. high risk)

Running background checks (financial, legal, compliance)

Reviewing their vendor risk assessment and security controls

Applying enhanced due diligence for high risk vendors

Documenting findings and updating them through ongoing monitoring

Is skipping third-party due diligence good practice?

No. Skipping third-party due diligence exposes companies to potential risks such as fraud, data breaches, regulatory penalties, and reputational damage. Regulators increasingly expect companies to show that they evaluated and monitored their business partners, so bypassing it can result in serious consequences.

What is a third-party risk?

A third-party risk is any risk to your business that comes from working with an external vendor, supplier, consultant, or partner. It can be financial, operational, reputational, compliance-related, or strategic in nature.

What is a third-party threat example?

An example of a third-party threat is when a software vendor suffers a cybersecurity breach, exposing your company’s customer data. Even though the breach happened outside your business, you’re still responsible for the consequences.

Final Thoughts

Third-party due diligence is no longer optional, it’s a business necessity. Every third party relationship brings value, but it also carries potential risks that can impact compliance, operations, and reputation. By following a structured due diligence process, applying a risk-based approach, and committing to ongoing monitoring, companies can build resilient supply chains, protect sensitive customer data, and align every vendor with their strategic goals.

The future will demand even more. From tackling fourth party risk to meeting expectations around human rights and ESG, organizations that invest in stronger risk management programs today will be better prepared for tomorrow’s challenges.

If you’re looking for tools that make this easier, SmartRoom offers secure, advanced solutions for vetting, monitoring, and managing third party risk throughout the entire vendor lifecycle. With features designed to save valuable time, maintain detailed records, and spot red flags early, SmartRoom helps companies build trust and stay compliant while focusing on growth.

Ready to strengthen your due diligence program? Explore SmartRoom’s solutions and see how you can mitigate risks and manage your business partners more effectively.

Matthew Small is the Vice President of Strategic Sales and Alliances at SmartRoom, where he builds partnerships and leads strategic efforts to deliver cutting-edge virtual data room solutions for dealmakers. With a strong background in enterprise sales and channel development, Matthew is passionate about unlocking new growth opportunities and helping clients navigate complex transactions with greater speed, security, and confidence.